Normal people tend to think of Inflation as a byproduct: the unwanted consequence of shop-owners’ greed (if you’re a chavista) or of government cluelessness (if you’re in the opposition.)

Normal people tend to think of Inflation as a byproduct: the unwanted consequence of shop-owners’ greed (if you’re a chavista) or of government cluelessness (if you’re in the opposition.)

Economists, by contrast, tend to think of it as a tax: just one of many ways the government puts its hand in your pocket, takes some of your purchasing power and transfers it to itself.

After all, each time the government prints money, it can afford more things – the things it can buy with the money it just printed – and you can afford fewer things, since each of the bolivars you hold is now worth that little bit less.

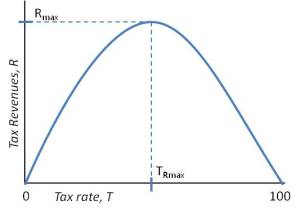

But if inflation is a tax then, like all taxes, it faces a Laffer Curve: a tendency for the revenue it raises to peak at a certain rate and start declining thereafter.

(A needed clarification: the Laffer Curve is highly controversial, but only politically. A furious controversy has indeed raged for decades on whether U.S. income tax rates were, or are, anywhere near the Revenue Maximizing point at the top of the Laffer Curve. Conceptually, though, nobody questions the idea that such a Revenue Maximizing point exists: it’s clear that if you try to tax income at, say, 99% you’re not going to raise very much tax revenue!)

Now, research by the economist everybody loves to hate – Bank of America’s Francisco Rodríguez – suggests Venezuela might be on the right side of the Inflation Tax Laffer Curve. And the right side of a Laffer Curve is emphatically the wrong side to be on.

Rodríguez shows real government spending has been falling over the last few months even as the government cranks up its inflation tax. In effect, Venezuelans are now spending their money faster than the government can print it.

To see how this works, you have to grasp what inflation is a tax on.

Inflation taxes real money holdings: cash you’re sitting on rather than spending. When the government creates money, prices go up, and when prices go up, the value of the money you hold goes down. How’s that value transferred to the state? Easy: the government just plain hands over the new money to itself, in the form of a BCV “loan” to PDVSA. (And, secondarily, via financial repression.)

As people catch on to this dynamic, their willingness to hold bolivars collapses.

You see this in all kinds of ways: when you see people standing in line waiting to buy something without knowing what it is they’re standing in line to buy, that’s a collapsing willingness to hold real money balances right there. People would literally prefer to hold anything of value rather than bolivars. When you see people struggling to get their money out of the country in any way they can, whether via sobrefacturación or paying whatever crazy black market rate DolarToday is quoting, that’s a collapsing willingness to hold real money balances right there.

In outright hyperinflation, of the kind Bolivia and Argentina went through in the 1980s, this dynamic reaches bizarre extremes, with people quite literally running to turn their paychecks into goods the second they got them. When hyperinflationary dynamics take hold, minutes count.

But you don’t have to reach that extreme for the effectiveness of inflation as a revenue raising mechanism to wobble. Already, the Venezuelan government finds itself chasing a mirage, printing money faster and faster, pushing people to work harder to hold less money, creating faster and faster inflation which, in turn, “forces” the government to try to create money even faster to try to keep up.

It’s a losing game.

The bottom line is that when you tax anything at a very high rate, you tend to erode it. Tax tobacco at a very high rate and people smoke fewer cigarettes. Tax income at a very high rate and workers work fewer hours. And tax holding money at a very high rate and people stop wanting to hold money.

At some point, the government runs up against its seignorage-maximizing rate of money creation and from then on out it’s on the wrong side of the inflation Laffer Curve, where more and more inflation brings in less and less revenue.

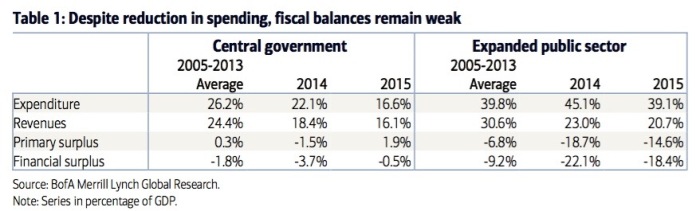

Why does the government crank out more and more bolivars? Because the public sector is deep, deep in the red, running a ginormous, unmanageable deficit worth almost a fifth of what the economy produces.

I’ve said it before and I’ll say it again: a broke state is a hyperinflationary state. As the state deals with its out-of-control deficit by printing money, it teaches people it’s better not to hold bolivars. The resulting “collapse in demand for real money balances” does double duty as economists’ definition of “hyperinflation.”

Of all the ways the Maduro administration is up a creek without a paddle, this might actually be the worst. The last trick in their arsenal, the final bit of revenue raising magic they thought they could count on, has gone barren for them. You know you’re shit-out-of-luck when even the damn printing presses at BCV won’t get you out of the pickle you’ve gotten yourself into.

If Madurismo was even vaguely sophisticated it would realize that the gig really is up now and that it has to adjust exchange controls and end energy subsidies at this point. When even inflation stops working for you, you genuinely have exhausted every other alternative and you’re left forced to do the right thing virtually by process of elimination.

But these guys have proven themselves so insanely self-destructive it’s hard to imagine even this will dissuade them.

“Now, research by the economist everybody loves to hate – Bank of America’s Francisco Rodríguez” —– Everyone except you Quico, you got a MAJOR man crush on him (and Krugman)

LikeLike

Hey, if he keeps writing great papers, I’m going to keep writing them up…

LikeLike

Leftists in Latin America tend to not believe in the Laffer Curve, they think that “greedy” private companies and the “criminals capitalist pigs” ruling them have an infinite amount of revenue that can pay whatever amount of taxes government requests. Those people have never run a company in their lives. Kind of cool to see a former Chavista like Rodriguez improving as an economist. The guy probably needed 40 years to “accept” the “controversial” Laffer Curve, but hell… Better late than never.

LikeLiked by 1 person

This is not right.

Every serious economist accepts that the Laffer Curve exists in principle.

What’s controversial is whether actual tax rates can be described as being near the conceptual revenue maximizing point at a given level.

LikeLike

It is the economic version of the uncertainty principle. You know roughly where the max rev point is, but you have to try something to figure out which side of it you are actually at. The problem is by the time you adjust, that rev point could have shifted due to other variables.

When I explain policy implications (in business or government) of the laffer to students, I usually explain it as climbing a mountain… As long as you are going up, you are okay. However, going down the backside tends to be something of an abrupt and fatal (career-wise) descent.

LikeLike

Very enlightening article!

LikeLiked by 1 person

“…or of government cluelessness (if you’re in the opposition.)”

Since when “The truth” and “you are in the opposition” are interchangeable terms?

“In effect, Venezuelans are now spending their money faster than the government can print it.”

Heheh, of course people are spending the money fast, a tiny date can cost up to 10.000, or “ten millions from the old ones”, and some times even more.

What was the country again where people used bill packs instead of actual BRICKS to build walls again?

LikeLike

This was not a good post, Quico. The inflation tax is one of the hardest things to explain in economics, and I don’t think you, erm, accomplished your goal of explaining it here.

These paragraphs need work:

Inflation taxes real money holdings: cash you’re sitting on rather than spending. As the government creates money, prices rise. And as prices rise, people’s willingness to sit on money falls: you know full well the race is on to trade your fast-depreciating bolivars for something tangible. Once inflation hits triple digits, sane people just don’t sit on unspent bolivars.

The catch is that as the willingness to hold bolivars collapses, the effectiveness of inflation as a revenue raising mechanism collapses too. When you tax anything at a very high a rate, you tend to erode it. Tax tobacco at a very high rate and people smoke fewer cigarettes, tax income at a very high rate and workers work fewer hours, and tax holding money at a very high rate and people stop wanting to hold money. At some point, the government runs up against its seignorage-maximizing rate of money creation and from then on out it’s on the wrong side of the inflation Laffer Curve, where more and more inflation brings in less and less revenue.

—-

I think people need to grasp better *how* inflation is a tax, i.e., it helps fund government spending. Once you do that, then we can talk about how the inflation tax is way too high, and how that relates to real spending.

My feeling is that this post is way over our readers’ heads.

LikeLike

Inflation is a government policy which creates winners and losers. Debtors gain when inflation is higher than the rate at which their debt is denominated, creditors lose, without any intervening government decision concerning how the $ is to be redistributed. And that is a good thing, since do I see a revenue stream on government accounts labelled “inflation income” which might be expended. It’s not really like other taxes. So what is gained by calling it a tax?

This is far beyond my capacity to comprehend.

LikeLike

Part of it is that in Venezuela by far the biggest debtor is the government. The financial system is awash in government bonds paying 14% a year, while prices double every 6 months. So yeah, debtors gain and creditors lose: it’s just that the government is the debtor.

LikeLike

well i got it just fine

LikeLike

Easy for you to say.

Math is Hard!

How much is the Base Barbie?

LikeLike

Also, one of the biggest commitments that the government has to fulfill is paychecks. But by increasing the monetary mass with no economic growth, you in effect decrease wages in real bolivars, but leave them nominally the same.

LikeLike

we may be too stupid too understand it, and definitely will not use these terms in conversations with el pueblo, but don’t blame the man for trying to enlighten us with new ideas.

LikeLike

I disagree, I think this post is not way over your readers’ heads… in fact I think it is very clear why inflation is a tax. The mathematical intricacies implications of that curve are not so clear and they are not properly explained but that’s OK, this is a blog post, not a paper to explain that.

LikeLike

“I think people need to grasp better *how* inflation is a tax, i.e., it helps fund government spending. ”

If a nation has 90illions of cash, which represents 100% buying power of the nation, then a government that needs 10% of the buying power could:

A) take 9illions out of the pockets of the citizens, leaving them with 81illions, or

B) print 10 new illions, leaving the citizens with the original 90illions.

In both cases the government ends up with 10% of the buying power, but, in (A), the citizens have 10% fewer illions, while, in (B), each illion is worth 10% less.

—

LikeLike

“But these guys have proven themselves so insanely self-destructive it’s hard to imagine even this will dissuade them.”

Self-destructive or simply incredibly Greedy? All they care about is getting richer as fast as possible before the ship goes down. For most, thousands of Chavista Crooks and enchufados, at all levels everywhere, it just means early retirement on some remote, very luxurious and pleasant location. They obviously don’t give a flying fuck about inflation or Economy principles.

For others, the few million who desire to Steal some more with the next MUD government, all it takes is to blame Maduro for the past, talk about change, praise the pueblo, the patria and even Chavez a bit more, and join the next Mega Corruption Festival MUD team.

There will be countless brand new opportunities to steal even more, pretending to fix the economic/financial mess in years to come.

LikeLike

“My feeling is that this post is way over our readers’ heads.”

Speak for yourself. I can certainly understand it, and I think that the vast majority of the readers here can too. Do you actually want to argue for “dumbing down” this blog?

LikeLike

Sorry. The above was supposed to be a response to Juan’s comment above.

LikeLike

Geez, seems like that’s an argument I am bound to win, given how I am the editor of the blog.

LikeLike

Enternal gratitude and admiration to you Great Omnipresent Master & Editor

LikeLike

Hm

LikeLike

Brilliant, Kep, just substitute the blond brain surgeon for F-Rod.

LikeLike

Actually, I meant economists all around. :-)

LikeLike

I’ve never seem them before. They are great!

LikeLike

And yet, you seem to be losing the argument anyway…

Juan, I don’t want seem to be just bashing you over this, but saying that understanding inflation is “over the heads of the readers” here is kind of insulting. In fact, I would argue that even the average Venezuelan gets it now. Their faces have been rubbed in it. The gross effects and impacts on their standard of living are simply too obvious to ignore.

LikeLike

You made me think of the kid who owned the ball and left the field full of pouty lips and of himself, just because he was losing and, well, owned the ball.

We get inflation. Thanks for the patronizing concern, though.

LikeLike

I am 100% behind Quico’s analysis. I always have a hard time understanding why any individuals would doubt that the rules of the game in Economics are what they are and trying to change or game the system will only hurt in the end. Economists will have a field day in the near future writing whole books about what created the disaster in Venezuela.

If you doubt me or Quico, read the most recent report on Bloomberg from Dr. Ricardo Hausmann here: http://www.bloomberg.com/news/articles/2015-07-28/harvard-professor-now-says-venezuela-won-t-escape-default-in-16

It is very sad to hear that the best minds in this field are now prognosticating a very dark economic future for Venezuela.

It will get much worse folks.

LikeLike

Hausmann’s analysis is akin to predicting that an egg will break when it has already been dropped and is half-way to the floor. It should not require a Harvard Professor to inform us.

LikeLike

Roy, you reminded of a Psychology 101 class I took in College, and negative reinforcements experiments done to ascertain if punishment and negative stimuli were a pathway to learning.

A monkey was trained to hit a chicken over the head every time the chicken tried to peck on the corn. The idea was to teach the chicken to avoid getting hit over the head by avoiding negative stimuli. The results showed that the chicken could not figure it out and it continued to get whacked over the head by the monkey.

Hausmann is the negative stimuli and I don’t think the chicken is learning.

LikeLike

Hey Quico, here is a signpost that you can refer to in 2016.

http://www.bloomberg.com/news/articles/2015-07-28/harvard-professor-now-says-venezuela-won-t-escape-default-in-16

Dr. Ricardo Hausmann is now prognosticating Venezuelan Default in 2016. All you need to do is bookmark today’s data 07/28/15 and check again next summer and see where we are at that point for inflation rate and default date. If he is right, you are right.

Sooner or later the shit will hit the fan.

LikeLike

I’d say the shit hit the fan some time ago!!

LikeLike

Knee deep in the stuff by now…

LikeLike

You can’t even get a fan anymore. No divisors for that.

LikeLike

Divisas.

LikeLike

My feeling is that this post is way over our readers’ heads.”

But you completely understand it and even criticize it, clarifying it for us uneducated dummies, huh.

Thank you! and for the utter CRAP you wrote on the last post!!

LikeLike

I think the Laffer Curve works best in economies where governments’ major source of income is tax revenue (income/corporate/sales/excise), not for the Venezuelan Govt. which basically lives off oil export revenue, and some sales tax income. Of course Ven. Govt.’s real spending is declining rapidly/markedly, when its major real income earner, oil exports, is at a level at less than half that of the previous year.

LikeLike

The problem with the curve is that it flattens out society as a single socioeconomic entity. In truth there is no Laffer curve but a Laffer *manifold*, in the simplest extension you have to add a socioeconomic indicator (say, yearly income), which means that there will be a different maximum for different socioeconomic strata

LikeLike

only want to add that inflation as a tax systematically screws up the poorest, as inflation behaves as a single plane of tax fraction across all socioeconomic levels, and the guys on the poor direction of the axis will all fall on the right side of the single plane tax

LikeLike

It is MUCH worse than a “single plane of tax fraction across all socioeconomic levels”. The wealthier classes have a larger fraction of their wealth in real property. The “tax” (if that is what we call it) is applied to the total sum of cash in hand, but not to net worth. For those who rent their housing and do not own a car, their entire net worth is essentially their cash savings plus some belongings. This “tax” burden falls far heavier on the poor than on the wealthy. What an incredible accomplishment for a government that came into existence on the premise of helping the poor!

LikeLike

^Hell yes, that.

LikeLike

Inflation as a source of revenue is a very blunt tax. It takes money away from EVERYONE but places the biggest burdened on the poor who have few ways of shielding themselves from it.

How ironic, el gobierno del pueblo now foists the bill on el pueblo.

LikeLike

I was shocked by this interview from Garcia Banchs in December:

The scariest thing he says is that people have a lot of money in the banks because they have nothing to spend it on due to scarcity. I think money in banks should be a good indication of whether we are close to hyperinflation or not.

He was wrong about his prediction for April. Yet, it seems like sooner or later time will proof him right.

LikeLike

There are now 3 notable economists either announcing outright or pointing towards a default for next year , they are Francisco Rodriguez , Ricardo Hausmann and Miguel Santos (Prodavinci ) . They all blame the govts passivity in taking certain required measures for bringing about that default . There is a difference between the first of them and the other two , F Rod thinks it might be possible in the end to fix the exchange rate by taking measures that avoid going to the IMF , the latter two believe that the IMF will have to provide the funds needed to fix the exchange rate once the default ocurrs. This latter action will be one which the govt will be loath to take because of the loss of face it will involve but the two economists are adamant , the exchange rate mess will need money to fix and there is only the IMF who will be prepared to put up the money. Maybe the govt is banking on the money coming from Unasur ( fat chance in a year when every one there is squealing bloody misery ) , or that the Bric or Chinese led recently created financial organization will do it . The Chinese of late have been clearly showing their reticence and skepticism at the regimes capacity to honour any financial commitment. They know the oil situation as well as anybody and they know the regime doesnt stand a chance of normalizing its economy the way its been acting so far. This leaves the IMF as the last resort possibility to fix the exchange rate mess. If thats the case the regime is going to have to become credible in holding to certain time honoured policies for stabilizing a countries economy , will Maduro be able to muster the courage to make such a commitment ?? Doubt very much so ?? so what does that portend for Venezuela and the regime . ?? its anybody ‘s guess !!.

LikeLike

Somehow, I can’t imagine the IMF negotiating with this regime. I agree that IMF funds will be necessary. But, it will come after the Chavismo regime has collapsed.

LikeLike

It is quite annoying to see again and again the Bolivarian government depicted as a bunch of appless twits who cannot run the country’s economy on the assumption that this is their objective. In fact their sole objective is to transfer the country’s treasury into their own pockets and oh boy are they ever good at meeting their goal. I personally marvel at their competence.

LikeLike

Well Said. Just what I wrote before.

Our “Intellectual” Economists just cannot refrain themselves from over-analyzing, buscandole 5 patas al gato, with nerdy Laffer curves and shit like that, trying to explain to the Chavista Mega-Thieves how to run an economy, from the theoretical perspective..

They call them “incompetent”, ill-informed, with the “wrong economic policies”, as if Chavismo Thugs were even trying to run an economy efficiently. As if Chavistas have not proven remarkable comptency when it comes to certain technical issues, like stealing Elections with sophisticated Smartmatic machines, running PDVSA for private massive embezzlement, screwing with the exchange rates for the same, highly competent purpose: to Steal, a Lot, and fast. That’s the plan, Stan.

Very simple: Steal as much as possible, as fast as possible, hold on to the coroto as long as possible. Screw the economy, screw inflation.

In what other way can with mess with the economy, private industries, food distribution, whatever it takes, to steal some more? What new deal can we make tomorrow? Milk from Chile? Rice from Uruguay (“oh, yes, I know a guy for that!”), spare parts from China (“50/50 pa ese guiso, como siempre chamo chin chin”), even with Guyana, Russia, North Korea, how can we bite off another chunck, otro tigrito con Derwick for used powers plants, sold as new, a couple of Billion in net profit ‘pa los panas? Dale!!

You have to agree, they are highly competent, highly corrupt thieves. Best on the Planet.

Inflation?? LOL, it’s the Yankees and the Spaniards and their imperialistic Wars.

LikeLike

Tony, I love, love your writing style. I think that you need to find a gig on TV somewhere and start lashing at these bastards with your wit and snark.

Your style very much reminds of me Jon Stewart from The Daily Show on USA Comedy TV Channel. He is the one I go to when I really need to understand what is actually going on. You have that ability. You have a gift.

http://thedailyshow.cc.com

LikeLike

I do believe that however much personal gain is important for ordinary people, the capacity of mediochrely acccomplished people to become obsessively beguiled with the possesion and use of absolute power. with the egolatric sattisfaction at exhibiting its showy trappings is really a much more powerful passion. one that can have a more corrupting influence in their mindset and behaviour than sheer desire for gain. The thing is that because we are taught by conventional morality (so influenced by the cult of poverty inculcated by Christianity) to scorn venality , that most basic and common of qualities which characterize the human condition, we feel we offend them more if we accuse them of being driven by corrupt venal motives , but the reality of the matter is that the fatuous passion for absolute power is one of the most corrupting and forceful passions of the human heart . Also this latter passion is easier to hide and mask with glamorous moral motives which add glitter to its display.

LikeLike

Quico, I would point out that there is an important difference between taxation via inflation and taxation via devaluation. Printing money is a way of taxing all money by making each bill represent a smaller percentage of the total buying power of all money (i.e., devaluation). In a free market, inflation is by definition a *consequence* of the market, not something the government controls. One could say that typical price controls are a negative tax through inflation. But, in general, a government does not benefit from inflation; it only benefits from printing money, which does not *necessarily* translate to inflation. In fact, printing is a more effective and efficient form of taxation than tax collection, and you know I’ve been suggesting that replacement for some time, now.

—

LikeLike

What, if anything, happens when it costs more to print the currency than the currency is worth?

LikeLike

The government issues bills of higher denomination. This should have happened long ago, but this government is in denial.

LikeLike

Ex torres raised a point which has me curious but which I cant understand by myself which is : what is the connection between Venezuelas inflation and its forex exchange rate mess , even if all dollars come from the govt oil revenues and the country is almost totally dependent on imports why is there such a broad difference between the inflationary fluctuations and the fluctuations in the exchange rate ?? is there any connection between the two.?? what is it ?? will someone kindly try to explian this .

LikeLike

Bill Bass,

Printing money forces the need for a greater number of bolivares to purchase identical batches of dollars, since each bolivar would be worth less by a direct, inverse amount to the amount printed. There is a lag between the time of printing and the time currency exchange rates reflect the devaluation from the printing of the bolivares. Because there is also a lag between the time of purchase of a batch of dollars and the purchase of containers of goods, by the time goods reach the market and are sold, their sell price may no longer match the replacement price. Since each wave of printing and purchases have a new wave of effect, the effects become additive when a new wave begins before the previous one ends. These additive wave patterns are sufficient for flucutations to become as complex as any such wave system, but buyers at every link of the market chain attempting to account for these lags and patterns with their best guesses for the future, making wilder guesses with fears caused by lousy government policies, only exacerbate the effects.

—

LikeLike

Thank you Ex , that was an excellent explanation !!

LikeLike

B.B.,

Three reasons:

1. The government is continuing to subsidize imports at much lower than market prices. This keeps food, drugs and few other things from falling directly in line behind with currency devaluation.

2. Labor costs in Bs. are increasing, but at a much slower rate than the currency devaluation.

3. Some items sold in the economy are still made in Venezuela, and are not directly tied to the dollar.

When you take all of the above into account, the percentage increase in prices is considerably lower than the decrease in the value of the Bolivar. Also, there is the lag in price increases that another commenter mentioned.

LikeLike

Thanks Roy , very clear and didactic. !

LikeLike

While inflation can be viewed as a tax, and it has the effect of discouraging people from holding on to cash, I think in the context of Venezuela this perspective oversimplifies the corrosive effect of the current currency regime. For one thing, taxes are in some way predictable and not generally retroactive (newly announced tax rules usually apply to future not past earnings). Accountants can therefore account for normal taxes (and for nearly uniform and low inflation) with ease. What is happening in Venezuela is quite different, and encourages behavior that is one of the key indications that one has entered a hyperinflationary regime: the inflation rate is unpredictable and high, and people no longer value goods in the local currency but rather choose a stable foreign currency. Businesses are encouraged to keep their books in dollars.

What’s more, the situation in Venezuela is even more toxic, because businesses are dealing with a mafia state which cannot or will not observe its obligations. Take the BsF denominated debt owed to the airlines: “You were promised repayment at 10 BsF:1 $? F&%¤ you ! I’ll give you 1000 BsF:1 $ ! And be happy, I’ll let you fly your f%&$ing planes out of the country. Oh, yeah, I’ll be a sweetheart and let you have the jetfuel for free. Oh no on second thought that fuels imported so f¤%¤ you, you can pay for the jetfuel with the dollars you were gonna steal you oligarch piece if sh¤t, and be happy you get to fly your stinking planes out of the country you miserable cocks&%$er !”

That’s a colorful way of illustrating how the “dialogue” has roughly gone between the government and the airlines. They are not getting “taxed”. Taxes are something civilized governments use.

LikeLike

It also engenders behaviors such as the looting of trucks and stores, the abuses of purchasing that support the bachequeros, and the outrageously conspicuous consumption of the Caste, who are taking delight in their sumptuary capacity while gloating at the suffering and misery of others.Also the murders of bridging persons such as Tibisay Uchenna and too many others. This regimen must go, and anything less than a democracy ought to be rejected by the people.

LikeLike

One thing I have never seen explained clearly is how increased money supply lowers the value of money. I know it’s economic gospel and I don’t deny its effect, but I reject the supply and demand argument, “everybody has them now so it’s worth less”. My understanding is that there is always an endless supply of money. If you invent the next big thing and become a billionaire and go to take out money at the bank they’re not going to say “I’m sorry, we’ve run out of money”. Money doesn’t have value because of scarcity, people don’t see a dollar and say “Hey, a dollar! Where did you get that?” like they would if you showed up with a diamond. I realize the deleterious effect that printing more money has is not because there’s merely more money in physical existence (if they printed it and kept it in a vault without spending it), but it’s because of its in circulation.

I also know that economics on the scale of national economies is something about which there is still much debate. National governments tend to go on printing sprees when the economic situation is already in trouble. So for me the effect of increased M2 on the currency’s value is a “which comes first, the chicken or the egg” situation.

LikeLike

When it comes right down to it, doctors aren’t *really* sure of what it is about heightened cholesterol and trygliceride levels that heighten the risk of stroke. But there’s tons of epidemiological data suggesting a link. Doctors don’t need to understand why it happens to know that it does happen.

The Liquidity-Inflation nexus is a bit like that. I don’t think you need to understand the actual causal nexus to accept its existence. There’s a ton and a half of econometric evidence linking liquidity and inflation.

But I think this question is well beyond what you can hope to get answered in a blog comments section.

Try -> https://www.mooc-list.com/tags/macroeconomics?static=true

LikeLike

Thanks! I did google it and still couldn’t really find an answer. One site stated that when there’s more money in circulation people loose confidence in their money, and I image some middle class guy coming home to his wife and saying “Honey, did you hear about the M2? I’m a bit concerned”. Obviously that doesn’t happen.

Yes, I agree the concept is gospel and to challenge it is heresy. But someone’s got to know why it happens.

LikeLike

I think you’re confused about how the price mechanism works more generally.

This isn’t about people cogitating on Central Bank statistics. This is about the quiet aggregation of millions of individual decisions about what to buy at what price given the money available to you. When you have more units of currency chasing the same number of goods, the aggregation of those millions of decisions will silently move the price level in a determinate direction. Nobody has to understand how it works for it to work.

Try: http://icm.clsbe.lisboa.ucp.pt/docentes/url/jcn/ie2/0POWCamp.pdf

LikeLike

NYG,

Try to think of money as you would any other commodity. If there is a glut of any particular commodity in the market, its price will fall because the supply outstrips the demand.

LikeLike

New York Grooved,

In a general sense, the total money of a country represents the total buying power of that country. Printing more money causes each bill to represent a smaller percentage of the total. The effect of this will vary depending on whether what is being purchased is foreign or local.

When paying for foreign stuff, the provider will want more of the bills for the same thing because the value (i.e., the buying power) of each bill would have gone down after the printing. So the price in your currency goes up for foreign currency, goods, or services.

When paying for local stuff, there is no exchange devaluation, so the price of local stuff won’t go up because of that. It goes up because now there is more spending money, so demand goes up. When demand goes up, the price of local goods and services will go up because that’s what markets do when there is a fixed supply.

Regardless of the complexity of proportions of the makeup, local or foreign, of a good or service, the price tends to increase with the printing of money. Add government policies that causes people to take wild precautions, and the effect will be wild, too.

—

LikeLike

Milton Friedman.

LikeLike

all we need is anarchism my latin american friends “ask for work, if they dont give work ask for bread and if they dont give you bread you might as well fucking take it”

LikeLike

But that’s what we have been doing for ever… There’s just no rule of the law around here my friend. We can “fucking take” that bread whenever we want to. it’s funny and cool in the beginning, but you will get tired of it, and long to return to a more “cruel” market-friendly laissez-faire capitalist society in like… two weeks!!!

LikeLike

that’s not true mate, what we have been doing is steal pieces of bread that fall of the politicians table, that’s what we have been doing, us latin americans have never gotten a chance to take a whole slice, take venezuela as an example…

LikeLike