On Thursday afternoon, Venezuelans found out how their foreign purchasing power evaporated – quite literally – by the minute, as the US dollar surpassed the 400 bolívares (BsF) mark. This was according to the “coup-plotters/saboteurs” from “Dolar today,” the most widely used web page for Venezuela’s black market exchange rate. Other web pages, such as Lechuga verde or Aguacate verde, are not showing it to be quite so high.

To give some perspective to this nasty affair, about a year ago the black market value for a dollar was almost BsF65. By December 2014, it was BsF175. Exactly three months ago, the greenback hit the BsF200 bar. Just a couple of days ago, it was at 350.

The only remaining question is whether the dollar will reach the BsF1,000 milestone by the end of this year or sooner.

So … is this really a conspiracy? Is it speculation? Or is it just plain economics? Let’s dig beneath the surface.

We’ve been writing about the paucity of official data and intel on key economic figures, and the dollar value is no exception. This great article by economist Ronald Balza written a couple of months ago in Prodavinci helps shed some light on this mystery.

In it, Balza explains what Dolartoday does. Dolartoday tracks the exchange rate of trading agents between the Colombian city of Cúcuta and San Cristobal. Although Colombia is not Venezuela’s only trading partner, what happens in Cúcuta is a sign of our exchange rate value vis-a-vis the dollar, given that is one of the very few places in which you can swap bolívares for Colombian pesos and, from there, for US dollars.

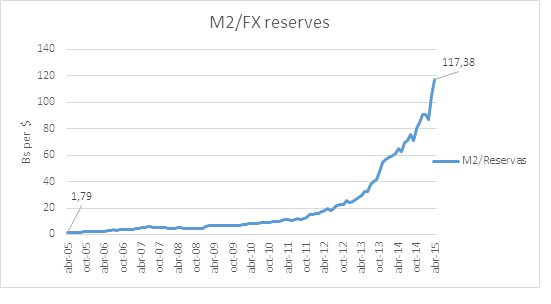

But if you’re still skeptical about those Colombian dealings, then look at what has happened to the ratio of local money (M2) to foreign reserves, the dollars backing it. In plain English, this ratio represents how many bolívares we have as a proportion of the amount of US dollars in our reserves. Back in April 2005, there were almost BsF2 per every $. Ten years later, 1$ in our FX reserves accounts to almost BsF118. What is telling about this other reference is not the value itseflf, but how much it has increased.

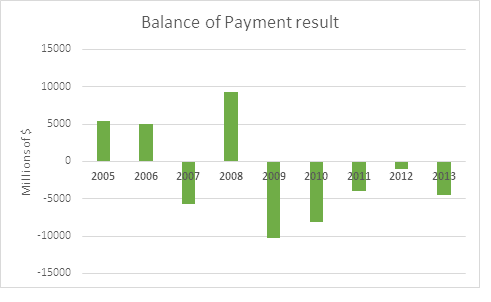

Yet another way of looking at it is by checking Venezuela’s balance of payments. In plain vanilla, the balance of payment represents the balance of transactions Venezuela has with the rest of the world. The net result of the balance of payments in a year represents the change in our FX reserves – if more money comes in than goes out, our reserves grow, and vice versa.

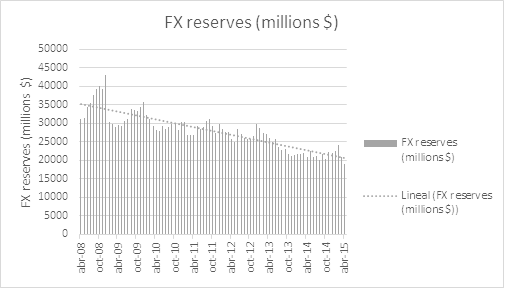

According to the Central Bank’s own figures, from the first quarter of 2009 until the 3rd quarter of 2014 (latest published statistics) there has been a decline of almost $29 billion in reserves, meaning that Venezuela has faced an annual balance of payment deficit for the past 6 years.

If the numbers freaks you out, also bear in mind that in late 2015, 2016 and beyond, Venezuela must meet payments of its foreign debt (both sovereign and PDVSA’s) and possible adverse arbitrage rulings, which account for billions of dollars more. Add to this a steep decline in oil prices and we’re in for a real treat of a macro-beating.

So the problem is not about ill-intended agents of a meretricious “economic war”. It’s just that our fundamentals are completely screwed up, and this is making people flee our local currency. It’s an all-out collapse in people’s willingness to hold bolívares.

Ultimately, what the government calls “speculation” is just a mean-sounding name for something people are desperately trying to do: hold on to their purchasing power by whatever means necessary. This is typical of economies in a hyper-inflationary environment, as our friend Francisco Monaldi reminded us a few months ago.

The worst part about this story is that it is nowhere close to being over. If all of the above becomes the norm, we will continue to be fundamentally screwed, and the dollar will scale new heights.

If I recall correctly, Lechuga Verde got shut a couple of times because they turned into some buy/sale site for dollars.

Also, as some economist said some days ago, “as long as the regime keeps the monopoly and doesn’t take any corrections to the system, the dollar can keep going up indifenitely.”

LikeLike

Correct–they’re not to be trusted, similar for AV.

LikeLike

How can this be possible? Those Americans told me Venezuela is a paradise and everything is an invent of Western media

LikeLike

Only 336 views on YouTube. Thus far, this stupidity has not gone viral.

LikeLike

I know many ordinary Liberals here who believe this and all other manner of stupidities.Most Liberals here in the US are quick to hate on the US …it’s a kind of unconscious psychological save from their underlying paranoia and fear of retaliation.Quite trendy and fashionable as well.” If I hate myself, other people might like more”

LikeLike

firepigette, you are so old fashion, “liberals” was what we called these morons 20 years ago. They now call themselves “progressives”. Same sh*t though.

LikeLike

At least these New York lefties put their money where their mouths are. They have outlawed fracking in their state.

LikeLike

Western media? Why that?

LikeLike

Dolartoday sets the market. Not Cucuta. In an information vacuum opacity rules and the government legitimizes them by attacking them verbally. Sounds awfully suspicious to me. That is Venezuela, where people believe profetas and astrologers, and now an anonymous web page.

LikeLiked by 1 person

Actually, it’s the inverse, it’s the people in Cúcuta the ones who set the market, because there is where most of the trade gets done.

But sure, go ahead and keep believing the bullshit fabricated by the worst government in history that couldn’t even do more than a simple web page because they are “too stupid and incompetent”.

LikeLike

So venezuelans are flocking to cucuta to buy stuff. With the purchasing power we have, venezuelans are selling stuff there. Haven’t you heard of them wanting to buy 100 bolivar bills? If the venezuelans were purchasing pesos the exchange houses wouldn’t be looking for venezuelan cash.

Follow the money, who has dollars to sell?

That should give you a clue.

LikeLiked by 1 person

“Follow the money, who has dollars to sell?”

The enchufados are the ones with dollars to sell.

LikeLike

Since people in Cucuta need Bolivars to buy subsidized stuff a raise in the exchange rate may be caused by a drop in the Bachaqueo activity at the frontier either because of lower supply of the products in the frontier states or due to tighter controls of bachaqueo activity.

LikeLike

Exactly. Then Cucuta is a micro-lab for testing venezuelan monetary conditions. The demand for BsF (from either colombian or venezuelan nationals) is now is purely transactional. Scarcity levels erode the only remaining motive for holding BsF and push movements in the exchange rate. My prior is that Cucuta might be distorted, but reflects underlying trends of venezuelan monetry conditions.

LikeLike

To paraphrase you. In plain English, it is that there isn’t much left in the Venezuelan Treasury to steal. That is why the reserves are in free fall.

Just for the fun of it, you should plot the slope of your FX Reserve graph and calculate when it will hit Zero at the rate it is going. My eyeball calculation tells me the slope will hit Zero FX Reserve on the X axis in about a year from now.

LikeLike

“The only remaining question is whether the dollar will reach the BsF1,000 milestone by the end of this year or sooner.”

My bet would be sooner. Every day that passes with gasoline selling for 4 cents a liter, is the same as taking that same gasoline and pouring it onto this inflationary bomb fire….Anyone bring some marshmallows?..

LikeLike

With $1 worth of gas I could now drive over 45,000 kms with our Toyota Corolla. Or if I could transport that same $ 1 worth of gas to Toronto I could sell it for $ 3,640 at current prices and exchange rates this morning.

LikeLike

Compare that to a civilized country, Norway, 2$/Gallon (not to mention high overall taxes)

LikeLike

Actually, about $2 per LITER: http://autotraveler.ru/en/spravka/fuel-price-in-europe.html#.VV9DkU_BzGc

1.88 E/L=$2.09101*3.78541L/G= US$7.92/Gal in Norway

LikeLike

Great news. This all means more inflation, longer lines, more bachaqueo, mas escasez, menos poder adquisitivo. Hopefully the shit will hit the fan before oil prices go back to $100/barrel, as it’s often predicted, and people get used to used to live like Cubans.

Hopefully, in December when they steal the elections again, and inflation hits 150%, people will finally have had enough.

LikeLike

Oil will never get again above, nor near, 100$ per barrel, that’s just a stupid delusion chaburros have because they can’t be bothered to do any actual work at all to produce anything.

Opec and other oil producers are interested in keeping prices below 60$ to stop fracking from overtaking the markets, that’ll be the roof for it for decades to come.

Also, inflation hit 150% a long time ago, maybe for this december it’ll be along 450-600%.

LikeLike

I think that the worst part is that even tough this disaster has been 16 years in the making, the government “economic/social plan” is not only running strong and undeterred, but that with Maduro/Diosdado and Co there is zero chance that they will change course. Zero!

LikeLike

The monopoly holder doesn’t let go his monopoly.

Chaburros are not stupid, just too “lambucios”.

LikeLike

OK, yes we agree on all of that, we agree that our economy has been managed by complete shitheads, our fundamentals are so screwed that the only healthy alternative would be a dollarization process.

Now here’s the thing regarding dolartoday: it has become sort of a price maker. You do not know who is truly behind it, it could be someone inside the government with access to cheap USDs. Moreover, dolartoday used to put in small letters that, if you personally contacted the trading agents in Cucuta, the price given to you by the agents could not be trusted because “they refused to give that information to strangers” or something like that.

Dolartoday can say they don’t participate in transactions but the truth is you cannot really verify that. Maybe is an operation held by the trading agents in Cucuta or maybe it’s truly an altruistic group of traders (HA!) following the price and sharing that information with the public, who knows.

If they do speculate, it is not necessarily a bad thing, they are just taking advantage of all the crazy arbitrages made by the central gov’t WHO is really to blame. What is truly a bad thing is having only one source of information guiding the prices. Yes, you also have aguacate and lechuga verde to check for the price, but they are not as widely spread as dolartoday is. Which means that dolartoday is dictating the FX price.

In other words, dolartoday has all the incentives to be screwing everyone up.

LikeLike

Problem is, the whole host of circunstances that make it possible for DolarToday to do that are… the fault of the government.

They are the ones that have created a situation in which necessary information for taking rational economical decisions have to relay in whatever strange channels are the only one giving any kind of signal, because from them all you get is silence or bonehead insistence in what everybody knows is false.

LikeLiked by 1 person

And DT also manages independent fx businesses in Cucuta?

http://cambiosmercurio.com/

LikeLike

If you read again, you’ll see I address the problem.

We do not know who DT is, in the old days, when DT had not become so spread it would warn that the prices given in Cucuta were “not real”. Now, DT is the market maker, meaning it can influence on the prices set by the independent fx businesses everywhere.

It could also be that it is managed by those independent businesses who decided to join and set the best price for them. Who knows. That is not the problem, the problem is that we don’t know.

LikeLike

“We do not know who DT is, in the old days, when DT had not become so spread it would warn that the prices given in Cucuta were “not real”. Now, DT is the market maker, meaning it can influence on the prices set by the independent fx businesses everywhere.”

Ant they STILL TODAY say those prices are NOT the real price.

https://ie31a80e9d7dtnnwg.wordssl.net/custom/rate2.jpg?nc=1

“* Dolartoday price: Includes bank and change house comission for transactions.

** Implicit: Monetary flow / International reserves according BCV”

*** Cash: Informal rate, Cúcuta street dollar paid in cash and received in cash.”

Meaning that, yes, the “buhoneros” of dollars are in the streets of Cúcuta, who are informal (aka NON-Regulated) agents who charge whatever amount they please for their dollars.

Also, it would do some good to take a look at:

LikeLike

That’s not what I am arguing here, what we are arguing is who is DT and is it healthy to have it as the only price marker. We all agree that the price given by DT is the price which all transactions take place (in other words is the “real” price). We also agree that it’s the government’s fault that DT (or Cucuta’s informal sector) has the power to set the price.

What we are discussing is the motivations behind DT.

LikeLike

If DT actually HAD the power to set the price, and actually wanted to destroy the government, why they just don’t go and set the price at 5000 Bs/$ Then?

LikeLike

Again, not what I was arguing here.

I very well said that DT could be people inside the government for all we know. Making themselves rich thanks to the arbitrage opportunity (WHICH IS TOTALLY HAPPENING).

LikeLike

The independent fx businness in Cúcuta you provided is giving an exchange rate of BsF 287,50 per dollar, and BsF 300 per Euro; while DT gives 402 and 443 respectively. It does look like DT has its own calculations.

LikeLike

Mayke, it is actually 480 BsF/$ (if you sell your BsF to them and you buy the USD from them)

LikeLike

Bernardo, I am particularly bad with calculations but, if 1 BsF are 7,30 Pesos, and 2503 Pesos are 1 dollar, aren’t BsF 343 one dollar then?

LikeLike

Use their index for buying/selling, since those are their rates with built in commissions.

http://cambiosmercurio.com/index.php

Buy/Sell on the bolo is 5/8.

Buy/Sell on the dollar is 2300/2400.

Dolartoday’s “headline” rate includes the commissions rather than the informal rate. So the two are apples to apples.

LikeLike

The spread is huge. 50% of the sell? That’s distortioland rates.

LikeLike

LVL, is that you?

LikeLike

But, how the gringos’ say: don’t hate the player, hate the game

LikeLike

The dollar will stop rising when confidence and trust is regained. This will ocur only after regime change and a new group of government officials are in place and start implementation of needed measures. How much more will the Bs.F sink before it can start to turn around depends on how long does the cuban led invasion and puppet regime continue and how violent and destructive the transition mechanism is.

My bet is that they are in still for a while, i do not read any signs of internal dissent nor crumbling don of their hold. The status quo will preserve itself for as long as there is more $$$ in treasury to steal and will seek out a explosive inflexion to cover its tracks. I have said it before, who is going to prosecute anyone abroad, when people are killing each other on the streets!…

500, 1000, 10000 Bs.F /x USD are in the horizon. Pero el tiempo de Dios es perfecto, esperemos a las parlamentarias y luego le lenazamos un RR a Maduro y lo sacamos y no paso nada! …

LikeLike

As long as the military can still make tons of real money smuggling gas and drugs there won’t be any change in the Venezuelan reality. They and the collectivos have the guns and are running the show.

LikeLiked by 1 person

The Opinion newspaper in Cucuta gives the local peso-bolivar exchange rate. If you calculate from that, the numbers are near identical to dollar today.

LikeLike

If the exchange houses are buying bolivar bills for over face value that means that the demand is for bolivars from colombia to pay here.

LikeLike

The demand for Bs bills will exist as long as there are products to buy on the Venezuelan side. As scarcity grows worse, demand for Bs dissapear along with the products.

LikeLike

So the demand is on the bolivar side, not on the peso side. If everybody was buying pesos with bolivars there should be a surplus of bolivars, not a shortage.

LikeLike

The Ven. international reserves are probably way overstated, so the situation is even worse than this article indicates. Add in some $10 bill. or more owed to U.S. suppliers, $10 bill. or more in pending intl. arbitration debts, some $5 bill. owed to Brazilian suppliers, ? bill. owed to Russian armaments suppliers, $10bill. in near-future international debt payments, many other $ bill. owed. to various SA nations, a price of oil going nowhere fast, declining oil production, a Pueblo passively waiting in lines to greatfully buy scarce below-cost basic foodstuffs, elections waiting to be stolen by the Regime, some $30 bill. or less yearly income barely/if covering food/medicene imports, an exploding M1/M2 Bs. currency–where do the doubters think the Bs./$ exchange rate sould be?–with the status quo, expect 1000 by year end. Oh, yes, but there’s “patria”, the largest oil reserves in the world, and “Venezuela Potencia”, that revels in honoring the world’s spies/crooks/canalla….

LikeLike

I forgot to mention that I utterly distrust the Central Bank’s numbers regarding the Balance of payment position of Venezuela. They claim that the country is exporting 2.4million barrels of oil per day which is bogus. so yes the deterioration in Venezuela’s external accounts is actually worse and hence there’re less reserves than what the BCV claims.

LikeLike

Reblog if you think Luís Vicente León is a pedantic arsehole who think he only understands economics.

LikeLiked by 1 person

Reblog if you think Luís Vicente León is a pedantic arsehole who thinks only he understands economics.

LikeLike

I know it´s a small detail but the headline should read “will the Bolivar stop falling any time soon?” putting it the other way around makes it look like the Dollar is the one doing all the moving…

LikeLike

In fact the Dollar is doing a lot of the moving besides Bolivar inflation, it appreciated about 25% over the last year against most major currencies.

LikeLike

As opinionesdekantinas opines above, I’m exceptionally skeptical of this movement. Dolartoday does provide a barometer, but while you can see a barometer indicating that pressure is going up or down, it doesn’t guarantee rain. There’s also the question as to whether dolartoday might have a slight, or growing, conflict of interest.

No trigger event/news that I am aware of for this push. At least, none of consequence that wasn’t widely known.

The standard deviation of the simplified change of the dollar value over the past 50 transacted days is 4.2%/ YTD is 3.7%, and both of those include the Simadi bump of mid-March in the calculation …yesterday’s movement was nearly 15%, and that’s not factoring in the previous couple of days.

To put it in perspective, when the government announced their CENOCEX/CADIVI/SIMADI/SICAD2/SICAD2.5 crap in March, movements were net smaller by percentage, but of a roughly parallel volatility level to what we saw yesterday, and in those cases, it went both ways, up and back down.

I don’t see any legs to this, barring some localized information in Cucuta, such as an impending border closing, sending large amounts of military from either side to “secure” a border, or a rumor that the economy was going to be dollarized or some other nonsense.

LikeLike

If you take the DT numbers at face value then the Vnzla government has enough hard currency to buy up every existing Bf at the BM rate, using only about 1/3 of their reserves (BM rate / Implicio rate). It should therefore be easy for them to support and strengthen the Bf if they wanted to, by simply starting to buy Bfs on the open market. Then, when the Bf approached the Implicio rate, they could buy back USDs and end up with more reserves than they started with. A “win-win” (sorry!).

The reason they don’t must be that, 1) the reserves numbers are bogus, 2) they have no interest in supporting the Bf, 3)they are incredibly stupid, or, 4)an unholy combination thereof.

LikeLike

should have read “(implicio rate / BM rate)”.

LikeLike

The reason is “5) They want people to be as poor and miserable as possible to keep them under control.”

LikeLike

5) DT numbers are fake.

LikeLike

If DT’s numbers were fake and just a bunch of asspulls, why they don’t go and set the price at 5000 Bs/$ right now? After all, they’re a bunch of mean conspirator worms driven by the exxxxxxtremeultrafascsist viejas encopetadas.

LikeLike

My understanding is that the majority of the reserves (approx. 15 billion US) exist as gold bullion held in Venezuela. This value is not liquid and, hence, not usable until converted to dollars by some means.

The current scheme for conversion is to transport the gold to a foreign bank and use the gold held in that bank as collateral for a loan in dollars. What occurs to my (admittedly non-legal) mind, is that creditors with valid, adjudicated claims settlements could attached and freeze that gold, once it is located in a bank located in a country that is signatory to the international arbitration agreement, using liens, followed by suits to seize the gold in payment of debts. If that were possible, then the gold would be fully non-convertible, and the international reserve calculation would go to almost nothing.

thoughts?

LikeLike

TOR, I think you are on to something. I recall a picture of Comandante a few years back fondling gold ingots and making a big deal over bringing gold back to Venezuela. The gov’t would be loath to put all their bullion at risk in foreign banks, hence the reserves will not be used to support the bolo.

LikeLike

There is $16,565 in a monopoly set

If a monopoly game costs $41 ( in Dublin €34 for the deluxe version) x402 bsF( bullshit Feck)

Can I use the play money instead of Bolos

LikeLike

Correction: It is not the Dollar that is rising. It is the value of the Bolivar that is falling (like a rock).

The traffic in Cúcuta is not completely representative of the real exchange rate. It is a small market, more volatile than the aggregate market, and is used primarily by bachequeros, narco-traffickers, and money launderers. However, it does serve as a effective leading indicator.

There were two recent news items that are driving this:

1. Foreign reserves fell abruptly to $18BB. That is a huge red flag.

2. The news of the investigation of the top Venezuelan officials by the U.S.

I think that a lot of people close to the top are feeling the heat and beginning to bail out. This is driving the fire sale of Bs.

LikeLiked by 1 person

Makes sense. What serious currency trader doesn’t read the WSJ? Knowing your item 2), they would suspect your last paragraph to be true even if it wasn’t, and start bailing.

LikeLike

The biggest, meanes and reddest flag is:

maburro announcing another devaluation (aka another exchange system)

LikeLike

OT:

One of the most importants newspapers in Brazil wrote an Editorial saying that Venezuela is on the path of becoming a narco-state, and that Cabello could be the leader of a drug cartel. Priceless…

http://oglobo.globo.com/opiniao/venezuela-caminho-de-ser-um-narcoestado-16206016

LikeLike

Just checked and it’s now at 421. ¡Rumbo al 430!

LikeLike

500 ‘pa la semana que viene, pana bulda. A bachaquiar!

LikeLike

The bottom chart says Reserves are falling linearly, but the top chart says M2 over Reserves is rising exponentially. This can only mean that the government is printing money like crazy! Unless someone acts like an adult and takes immediate, dramatic action, you can extrapolate the top curve and conclude it is only a matter of weeks when the implicido rate (M2/Reserves) catches today’s BM rate.

On this basis, the DT data makes perfect sense, as traders/investors try to trade the future. Time to dump your Bolos, ASAP. Hyperinflation has arrived and nobody in the government gives a damn!

Excellent article!

LikeLike

If you are a business man and need to figure the replacement value in Bs of any item for the future , you factor in the inflation which you think will apply . If people think that inflation is going top speed ahead with nothing to stop it then you apply not the actual current exchange rate factor but the inflated one you assumme will apply in future . The question to ask is , if inflation was at 0 percent how much would the exchange rate rise .!!

LikeLike

sometimes things doesn’t work out the way we want them to, and these may be in our marital and financial lives… The life we are today is full of ups and downs, filled with problems, heartbreaks, poverty and everyone needs solutions to their life’s problems… True and lasting solutions are hard to come by, because real those who can help get the solution you need are very few on earth today… most people had ended up trusting the wrong people for solution which thereby compounding more problems for the, but i want to tell you today, that i MR LEOPOLD the spiritual servant of the most high is here to render you solution to your life’s troubles… no body in life is made to be alone, childless, or poor, it is an error which must be corrected… are you BARREN, POOR, SINGLE (divorced or separated or never married) and you are in need of life partner, money or child, then search no more as i am here to help you with your problems.. Help yourself today by contacting me through my official blog or my email: simonleopold500@gmail.com…. remember: THERE’S NO PROBLEM WITHOUT A SOLUTION

LikeLike

And here we have another example of the negative affects of economic chaos. When times are hard and uncertain, charlatans, “snake oil” salesmen, and other low-life con men crawl out from under their rocks and thrive on honest people’s misery. Triste…

LikeLike

A friend of mine, who imports cell phone accessories with dollars from the parallel market, told me last night that she has suspended sales for the moment. She has no idea what the replacement value of her stock is, and is waiting for the market to “stabilize”.

LikeLike

Is this the Goverment answer to stop people / companies buying more dollars ? Twit by Jose guerra

https://twitter.com/joseaguerra

Jose Guerra @JoseAGuerra · 34 min hace 34 minutos

Imponer un corralito a los bolívares mantenidos en el sistema financiero para evitar la compra de $ sería el mayor de los a absurdos

LikeLike

Wasn’t the “corralito” the thing that almost destroyed a government in Argentina some years ago?

LikeLike

Yes, but different circumstances:

http://en.wikipedia.org/wiki/Corralito

LikeLike

OT, does anybody know what happened to Caracas Gringo ? Almost 1 year frp his last post …

https://caracasgringo.wordpress.com/

LikeLike

Carlos, if you can, re-plot your M2/FX chart on a logarithmic scale. That will give us all a better picture of the long trend with which to base predications.

Best Regards,

Deedle

LikeLike

Excuse me – i meant PREDICTIONS!

:)

LikeLike

Rumors in Twitter that they are going to shut down tha banking sistem for several weels and establish a “new socialist monetray system” including bills and coins with Chavez face….

@elcitizen Citizen there are serious rumors about change of the coin with the face of Chavez?

LikeLike

Hugo Santaromita @HugoSantaromita · 14h 14 hours ago

Cuidado con el “corralito bancario”. Maduro estaría a un tris de decretarlo. Adquieran mucho dinero en efectivo y compren todo lo que haya.

LikeLike

Hugo Santaromita @HugoSantaromita · 14h 14 hours ago

Los enchufados son los únicos que tienen millones de bolívares para comprar los dólares en Cúcuta. Ellos están provocando todo esto.

LikeLike