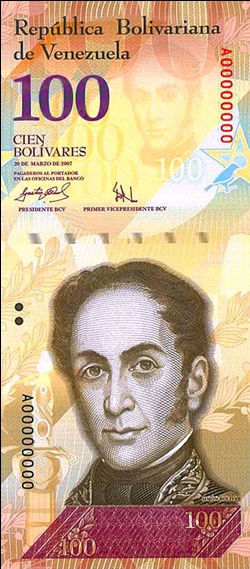

A year ago, the 100 bolivar banknote you see here on your left – Venezuela’s highest denominated, mind you – would buy you 92.6 U.S. cents on the parallel market.

A year ago, the 100 bolivar banknote you see here on your left – Venezuela’s highest denominated, mind you – would buy you 92.6 U.S. cents on the parallel market.

By last Wednesday, that note was worth less.

By then, it could buy you just 49 and a half U.S. cents: 46.5% fewer cents, over the space one year.

Today, that same crisp bill is worth less.

As of yesterday, someone would trade you just 37.9 U.S. cents for it.

That’s 23.5% less, in a single week.

If that doesn’t give you a case of exchange rate vertigo, consider this: at the rate the bolivar has been losing value over the last week, by March 2016 one U.S. dollar will cost 12.4 million bolivars on the parallel market.

For the old-timers, that’s 12 millardos de los viejos.

That’s an extrapolation, not a forecast.

Still, the takeaway is clear: Venezuelans’ willingness to own bolivars appears to be eroding at an accelerating rate.

And that is…not good news.

And yet, this outcome was totally unsurprising.

With the announcement of the SIMADI rate, the government more or less capitulated to the black market. By publishing that rate, they indicated a complete lack of confidence in the currency…however, it did temporarily (in days, at least) slow down the delta-dollar rate. Had the government successfully flooded the market with dollars at that rate, they may have ended up “winning” insomuch as far as sating dollar demand.

Our experiences with SIMADI have been 1 for 3. A small transaction (for bolivars) passed through with no issues at 174. The other two, larger transactions (for dollars), failed to go through at all. Part of it is the byzantine restrictions layered on banks and their ability to match buyers/sellers externally. It goes deeper than just that, however.

What the government failed to consider is that the dollar buy-side is so much bigger than the sell-side. This was manifested and is a consequence of placing the SIMADI rate so close to the parallel rate, since the transaction costs for the parallel dollar in Cucuta (time/effort) would have been more than outweighed the 10% discount of buying SIMADI dollars at that time.

That is, assuming the government had the dollars to sell to the intermediaries in the first place. I’m not so sure they do.

No one wants to hold the bolivar. It increasingly fails the four functions of money: a unit of account (just ask Ford), a medium of exchange, a store of value, and a standard of deferred payment (for the last three, aside from gasoline and non-existent store items, what can you really buy with it today that won’t change in price tomorrow).

When that happens, it is, as your title says, worthless.

Fun fact: 7-8 years ago, you could order in physical bolivars from a local branch of almost any mid-size to large bank in the US assuming you were going to Venezuela and you had to wait, at most, 48 hours for delivery. Try ordering bolivars from any bank now and see what they tell you as far as cost/delivery window…

LikeLike

As has been said many times before, this is the Zimbabwezation of Venezuela, a natural extension of the policies pursued over the last 15+ years by the looters in office. When a country loses all production capabilities, the natural consequence is that it’s currency becomes worthless, even with the massive oil revenues this country could enjoy- PDVSA is also collapsing, both physically and financially. The last ruling in favor of ExxonMobil just confirms the trend. They’re loosing on all fronts, and the debts keep on mounting.

But the Bs. 64 gazillion question remains, when will it finally collapse?

LikeLike

You just invented an acronym for LIO

Looters in Office. Venezuela, enredada en tremendo LIO

LikeLike

Good pun.

LikeLike

Looks as though Maburro better start printing much higher denominated currency. Of course this is all a conspiracy and has nothing to do with total mismanagement of the economy. The Chavistas really should take some classes in basic economics. Unfortunately, the population literally pays the price for their incompetence.

LikeLike

That’s a nice looking note, multiple overprinting with anti-counterfeiting (lol) techniques. Wonder how much a sheet of them costs to print?

LikeLike

Interestingly taking the numbers from dolartoday the implicit rate is going down because foreign reserves have gone up. Whats up with that?

Really I have to wonder if the government has a longer term plan. The issuance of a higher (“free”) rate close to the black market would suggest they were starting to get a clue.

Also, what can the government due at this point. I don’t think any government could contain the current crisis, certainly not this one. What kind of direct foreign investment would be required to salvage the losses due to the dropping oil value? Perhaps Venezuela should merge Pdvsa with Exxon.

LikeLike

Simadi is basically not operational:

http://www.el-nacional.com/economia/Casas-cambio-divisas-vender-Simadi_0_585541624.html

The government is not responding. They are not taking any useful measures.They are sitting on their asses. They attribute falsely the source of the crisis to non-existent threats. And what’s worse, even if they wanted to there isn’t much really to stem the losses.

Your patient is dying Toro from multiple gunshot wounds on top of an infection and a heroin addiction, the blood bank has run dry, the pharmacies are closing shop, the real doctors have fled, the nurses are on strike, the surgical equipment has been stolen, the medical books have been burned, the water main is broken, the internet and all electricity is down, and there are hounds howling at the door. What do you do? What is your triage protocol?

LikeLike

Well, the first thing any sane government would do is to begin printing 1,000 and 5,000 Bolivar notes. Then you raise the price of gasoline, electricity and water to its actual cost and then,…oh forget it. This is getting silly, grab some popcorn, this baby is going down in flames….

LikeLike

Unfortunately popcorn looting is also rampant and the microwave is busted, but you are on to something. Venezuelans love showbiz and Hollywood loves Venezuela. Solution is obvious, create a free commerce (“free-barter”) zone to encourage movie enterprises to set their tropical-themed movies in Venezuela. Start with follow ups to “2012” and another in the “Escape from …” franchise, this time set in Caracas. And “The Mummy Returns” of course. Toro, you ready to start on the screenplays?

LikeLike

“Your patient is dying Toro from multiple gunshot wounds on top of an infection and a heroin addiction, the blood bank has run dry, the pharmacies are closing shop, the real doctors have fled, the nurses are on strike, the surgical equipment has been stolen, the medical books have been burned, the water main is broken, the internet and all electricity is down, and there are hounds howling at the door. What do you do? What is your triage protocol?”

You know what, I refrain from economy articles such as these because I’m not familiar with the subject and I fear that if I open my mouth I’ll embarrass myself. Thank you for explain it down for the common man with a wonderful analogy.

LikeLike

Give the dude a “tiro de gracia”. Unfortunately, the only ones who can do that are those funny little men in green garbs (not Martians mind you). What is coming is ugly, far worse than Maduro and his gang of thieves.

LikeLike

If only they could shoot straight… better to point the patient to the torre de David… gravity (unlike chavismo) doesn’t fail.

LikeLike

The first thing you do is to have a 3-hour TV cadena every other day in front of slogan-chanting red-shirted paid fanatics to denounce the “Guerra Economica” caused by the “Pelucones Oligarcas” and the “Imperio”. Then, you have a poorly-attended march a week of paid slogan-chanting red-shirted Pueblo ignorants in honor of the “Comandante Galactico”. Then……..

LikeLike

I think they should go into reality TV. “Survivor” set in the Torre de David or somesuch. Or how about TV game shows like “the great race” were chavista versus oppo contestants have to get all the ingredients for a cake, with Emiliana Duarte as host (it’s obvious who wins each time of course)

LikeLike

A great idea–a Three-Legged Great Race, as in old picnic times, with Oppo and Chavista 2-person teams, each bound together by one leg, competing for a half-red/half-blue cake, held by Emiliana–Everbody Wins!

LikeLike

That’s what you get when a country is run like it is disneyland. As a government you have several options to balance you checkbook. Most governments use taxes to do this, but this implies that your country should have a functioning economy, business which employ people etc.

When all fails you can also get the money from your people by controlling inflation. Basically you devalue your currency and thus you rob people and businesses from their savings. A lot of governments are practicing this “quantitative easing” model, but Venezuela is living it.

The good thing is that you as a government can blame the economy, interference from external forces or maybe an alien abduction for the devaluation of your currency because John Doe basically doesn’t understand why his money is getting worth less. You can also obscure it a little by subsidizing consumer spending. Like handing out money for people who go abroad (cadivi) or by subsidizing basic products..

The problem is that your people are living in Disneyland now. Something that is happening in Venezuela. People do not see that 1 coin (euro) is now worth almost 3 of their highest denominated bills. You really need to explain to them what is going on.

The other day for example, I showed a friend of mine that his income used to be 2500 euro a month when exchanged to euro. Right now he is making about 300 euro a month.. And his business has grown quite some since then.. So he used to be ok for western standards and now he is poor.

And that is something that most Venezuelans just don’t get. That their government who they voted for is robbing them blind and pulling up a smokescreen while doing so. Imagine what would happen if Venezuela went cold turkey and that every product will be priced at their real economic value.. Everyone would find themselves being poor. Even moor poor than most 3rd world countries. It is a shame

LikeLike

I WISH Venezuela were run as well as Disneyland: Safe, clean, and well-maintained.

LikeLike

Of all the technical definitions of Hyperinflation out there, is there still one under which we are not in it?

LikeLike

Yeah there is one. A normal government would default on its bonds instead of continuing robbing their people. They guys in Venezuela rather rob their people even more. Get rid of the intellect, become restrictive and basically stay and follow the “totalitarian handbook” written by the castro family. It works, they have been in power for more than half a century. But still: revolutions have started with less reason..

LikeLike

Reblogged this on nEwsmaster.

LikeLike

I touch upon the same theme in my blog, today: http://www.lasarmasdecoronel.blogspot.com, trying to quantify where the money has gone. It seems incredible that there is so little to show for the $1.4 trillion going into the country during the 1999-2014 period. No matter how you split this money the size of the GUISO has been enormous.

LikeLike

At a fairly granular level, wondering how much of Venezuela’s oil was used to put the current President’s face on page 11 of Canada’s national newspaper — next to a story about Russia’s high-profile crimes, a mine disaster in Ukraine (33 miners dead) and the Calgary Stampede’s Bull Sale.

LikeLike

I placed an ad in the Globe and Mail on behalf of a client a year ago. A full page ad cost $19, 000 at that time. It depends on the day of the week, and where the page is located, too.

LikeLike

$19,000 Canadian is about $15,000 US. That translates into about 300 barrels of Venezuela’s crude. Meaning, about 6877 lbs of Nicaragua Venezuelan quality coffee… for one glitzy newpaper ad in one paper.

LikeLike

Great post. I’d love to see the Venezuelan pie as it changes in size and slices over time (along the lines you present). These idiots started out feeling that the system as it stood would not deliver what they wanted, so they went after the whole pie, oh their audacity was inspiring, the people confusing luck and opportunity with leadership and management wits. Once in power they were overcome with a feeling of invincibility. Same thing that must have happened when Fidel took La Habana, they became intoxicated by a feelings of superiority. Fools.

LikeLike

There is a new currency attempting to substitute the old one as a means of sattisfying peoples needs , the currency is all the rich BS that the govt spouts to celebrate its great imaginary achievements and hide their failures and the countries bankrupt situation by blaming their enemies. BS is the new currency , it even has an accronym that is similar to that of the old currency !!

LikeLiked by 2 people

Bullshit is cheaper than actual progress and development.

LikeLike

Pero tenemos patria, y eso es lo que importa, sea lo que sea la fulana patria…

But we have fatherland, and that’s what matters, whatever it is the so-called fatherland…

LikeLike

It is an autonomous country run by an authentic government that liberates the people from the chains of The Empire. Just recently the mercenary aviation wing of a insurrection force was apprehended along the border with Colombia, and our loyal soldiers once more liberated the people from the specter of enslavement and degradation. It matters not that the captured agent provocateurs turned out to be Christian missionaries. Lest you scoff, I will tell you that you would beg for the days of long lines and inflation were the Jehovah’s Witnesses to go door-to-door in your neighborhood.

LikeLike

JW’s? Quick everyone behind the couch!

LikeLike

Hahahahaa! This made me laugh a lot! xD

LikeLike

“You can’t forget that the supreme colonoscopic coward ensured our legitimate right to explode people’s heads with shotguns and 9mm rounds!

But we are peaceful! And if you complain we will kill you and everybody else!”

Heh, it’s easy to imagine a red fanatic foaming at the mouth while shouting all that crap.

LikeLike

Quico, thanks for getting the percentages right. Time and again I see people using them wrong – politicians, journalists, even economists.

For example, if the bolívar goes from 230 to 270, people say “the bolívar lost 17% of its value.” Why? It went up by 40 Bs, and 40 / 230 is 0,173. But that’s not the right call! The way you did it – comparing how many dollars it costs to buy 100 Bs before to haw many it costs afterwards, is the right way to assess the changes in the bolivar’s value. The exercise above tells us the percentage by which the dollar gained strength relative to the bolivar.

LikeLiked by 1 person

Quico, Juan,

Actually, there is a small clarification to be done here.

In Central Bank jargon, when you talk about devaluation, you usually refer to the Exchange Rate itself –BsF. per US$- so it is correct to say “the exchange rate devalued 20% last week”.

On the contrary, when you talk about depreciation -either nominal or real- you talk about the value of the currency itself -the BsF-. In the latter you have to make a reference to other currency or basket of goods, as in “the Bolivar depreciated 20% last week”. In the latter, it is correct to use the US$/BS. relation.

It´s just two ways to describe the same phenomenon.

LikeLike

Alcoholics and drug addicts have to hit bottom before they can begin healing.

Venezuela’s government still has a lot of digging remaining but their pace is accelerating. They need flashlights because the sun doesn’t reach that deep.

The devaluation means we send money to family in Venezuela is small monthly amounts rather than one large payment covering several months. The large payment converted to Bolivars loses too much value over several months. The good news is that the dollars we send can buy much more over time.

LikeLike

Venezuelan’s have demonstrated that they instinctively understand economic value. They have come to the painful realization that the Bolivar is intrinsically valueless. They are dumping Bolivars as fast as the “black market” is willing to absorb the currency. The only reason that the intrinsically valueless Bolivar is still used as money is because of government decree.

This just goes to prove that the economic laws of supply and demand work even in though the socialist government (if you can really call it that) in Venezuela has done everything it can to stomp them out.

Even the conveyer’s of Government BS don’t believe what they are saying. After all their “currency” is safely stored away in secret accounts around the world.They are not socialist. They are just a bunch of thugs and drug lords robbing the country blind.

……

So who in the black market is grabbing up all of those Bolivar’s that are intrinsically valueless. There must be a few people left that believe in the future of the country!

LikeLike

Probably those buying for Bs. Govt. price-controlled goods, which are then sold across border for hard currency, which is then changed back into Bs., though this turn-around should have a net neutral effect on the market price. Then, theoretically, there may be those who believe in a Regime crumbling, IMF bailout, unified 75 or so exchange rate, and a windfall gain, although, if the current situation turns into Cuba2, then we’ll see an endlessly worthless local currency.

LikeLike

FT, how DARE you post this on March 5, the Second Anniversary Of “La Siembra” of “El Comandante Eterno”. And, everyone knows that Venezuela has all the $ it needs, and that this is all a BIG CONSPIRACY–why, this year’s oil income of $30 billion divided by a 30 million population works out to $1,000/year for each man/woman/child, or a little less than $3/day, assuming no international debt payments/oil industry investment/etc.!

LikeLike

$3/day? Hey, that’s more than twice the poverty threshold as defined by the World Bank..

LikeLike

Gross dollar sales is one thing, personal income is another.

LikeLike

I know :-\

Actually, I dropped a comment here about that, about a year ago.

http://caracaschronicles.com/2014/05/14/slow-cooked-stability/#comment-142530

And the estimate was based on $80B/yr gross receipts, before the Saudi decided to throw the towel and oil nosedived (and Venezuelan crude even more).

Now, with oil prices and production down compared to a year ago, my estimate of available dollars is … $0 per day per inhabitant. Zero, nada, zilch.

LikeLike

Pretty much true, after international debt payments, obligatory $ oil industry investments just to keep production from declining too fast, obligatory arms purchases to keep the military from completely taking over too fast, aid to Cuba so that Maburro will know what to say/who-what to accuse, and the usual astronomical corruption. Believe, as in your 300+ average annual decline projection below, we could soon momentarily stabilize around 300, since normal markets like round centenarian numbers, but Venezuela’s situation is far from normal–and, we have coming May 1 minimum wage/Bs. liquidity hikes, accompanied by gasoline hikes, which Bs. liquidity will be used on steroids to win/fix the Parliamentary elections, which may be held only to try and legitimize the Regime in the eyes of those with the most guns, who, with their extensive hurting families, are starting to realize that, “No hay real.”

LikeLike

“No hay real, pero hay balas”

chaburros seem to think that they can defy this forever:

“Remember that number : $3 per day per inhabitant. That’s what the Chavistas have to keep the country somewhat fed, somewhat clothed and, above all, under control.”

They think that one bullet or shell is less than 3$.

LikeLike

#fuckinginflation

LikeLike

Isn’t it about time they renamed the Bolivar Fuerte to something else? Bolivar Medio Chimbo?

LikeLike

Unfortunately all those brand new 100 Bs notes they keep printing they are so crisp and the ink so fresh that they don’t work very well as TP. Am down to my last few rolls and might have to read up on survivalist culture to figure out what to do when they are gone because I am not holding my breath that they would let a stinking gringo have some of the Trinidadian TP.

LikeLike

Start asking for “tusas” to replace TP.

LikeLike

In memory of the two year anniversary of when Hugo Chavez ‘cash’d it in’ I would like to present Laura Branigan’s version of that fateful day. All you have to do is to replace ‘Spanish Eddie’ with ‘Venezuela’ and you have the making of a great hit! Er, ah, maybe. Her words:

“The night Spanish Eddie (Venezuela) cashed it in

They were playin’ ‘Desolation Row’

On the radio”

Sorry, I know it’s silly, but what the hell…

LikeLike

Great video/music. Silly is only as silly does…anyway, “Life Is Just A Box Of Chocolates.”

LikeLike

No vale, lo que van a hacer es poner escenas importantes en la vida del Gigante en todos los billetes de nuevas denominaciones: El de un millon (equivalente a $1 como por 15 dias): Chavez en los brazos de la abuela Maria. El de 5 millones: Chavez vendiendo aranas. El de 100 millones: El close up de abajo pa’arriba bajo la lluvia antes que guindara los tennis.

LikeLiked by 1 person

How fitting: “Simadi, we never knew ye, RIP”: https://dolartoday.com/muy-grave-bcv-suspende-subasta-de-divisas-para-casas-de-cambio-y-bancos-ahora-es-dedo/

LikeLike

Coincidentally, I read this post within minutes of finding and beginning to read this, on Zimbabwe:

http://www.cgdev.org/publication/ft/zimbabwe-hemorrhage-stability-personal-journey

LikeLike

Whatever is happening is accelerating like hell. So, are we starting to see the real impact of the lower oil prices? All the fat (as few as it was) burned, now the hunger goes to the bone?

LikeLike

Well, it backtracked a bit, for what I see. 269.

Is that going to be the new level or do you think it is going to go up again soon?

LikeLike

At which point does the paper that the money is printed on becomes more valuable than the money itself?

LikeLike

Manufacturing a $20 US bank note costs 10.3 cents according to the Fed, and 4.9 cents for a $1 note. I imagine the 100 Bs note, worth 35 US cents, is in the same league as the $20 US, nowhere as secure as US notes but fancier/prettier. So, it’s still profitable to print those notes.

But, for the 20 Bs, it’s already over.

LikeLike

Actually, there may be an arbitrage to be had with 2, 5 and 10 Bs. Their paper may now be worth more than the face value at current exchange rates. A bit bulky but an enterprising recycler operating in Colombia may be able to set up a neat little business.

LikeLike

Reblogged this on Fino Cambur and commented:

I’ve been wanting to write a post about devaluation for almost a year now but never got around to it. Today, Francisco Toro, from Caracas Chronicles, made it all clear.

LikeLike

Where in the world is Rafael Ramirez???

LikeLike

Why? You think the situation is not already bad enough?

LikeLike

Mmm, funny…

If you plot the Bs/USD rate on a log scale, you realize that the Bs is actually not doing so bad … yet.

It’s simply reconnecting with the very regular trend of a 12 %/month depreciation it had from late August 2012 to the end of February 2014 (12% per month depreciation means 290% per year, because compounding interests and all that, or the Bs losing nearly three quarter of its value each year, if you prefer..).

If that trend had been held since March 2014 as regularly as it had for the 18 months prior, the Bs would trade at about 334 Bs/USD. So, it still has 53 to go…

LikeLike

It is a good thing I never stopped speaking in “thousands” or “millions” as we did with the old Bolivares, because it looks like soon enough we will be using those values again to refer to the price of goods..

LikeLike

Does anyone know a good internet site for daily monitoring of the Venezualan black market for VEF/USD? A local Russian businessmen got paid in bolivars for his exports to Venezuala (we are talking millions of bolivars) and now wants to exchange this sum of money to dollars or roubles. However, we need to know the black market exchange rate in real time, so that the deal is fair. We want to make the currency deal in Moscow, but tie it to the Venezualan black market rate.

LikeLike