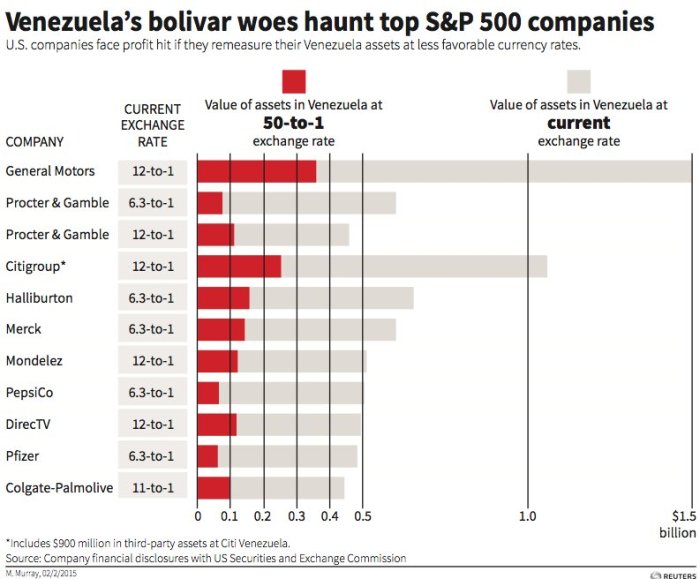

People are starting to put 2 and 2 together. This Reuters report finds that 40 major U.S. companies have big-time exposure to the Venezuelan shitshow, in the form of at least $11 billion dollars worth of paper profits in bolivars that are going to vanish in a puff of logic the second the Bs.6.30:$1 fiction – or even the Bs.12:$1 fiction – are finally abandoned.

What results is a kind of orgy of red ink:

That’s a lot of pennies dropping all at once.

Probably the craziest bit, though, comes relatively far down the piece:

Ford Motor Co and oil services company Schlumberger NV took big-ticket hits to their quarterly profits because of their Venezuelan operations. Ford took a fourth-quarter charge of $800 million and Schlumberger $472 million.

A Ford spokeswoman said that it still values its Venezuela assets at about 12 bolivars per US dollar. But for Ford, the currency system and other conditions are so tough in the South American country that it has made an accounting change that will allow it to ring fence its Venezuela business so that it doesn’t have a direct impact on the company’s operating results.

It’s hard to parse that, but it looks like Ford has, in effect, taken its Venezuela operations off its U.S. books entirely, treating its subsidiary like a financial asset that may (or may not) one day pay a dividend. (Which, when you think about it, is probably the most honest way a foreign company could treat its bolivar profits a estas alturas del partido.)

Other companies had been moving to revalue their pent-up profits to the Sicad 2 rate but then – surprise! – Maduro announced the Sicad 2 rate would be abolished, or at any rate transformed into a new permuta(ish) system that so far exists on an existential plane of near pure abstraction. Much gnashing of teeth and pulling of hair ensued.

You can follow the ins and outs of how multinational capital tries to adapt to all the craziness, and there’s a certain amount of fun to be had in doing that. But, in the end, there’s no chapter in the little accounting handbook back at corporate HQ that explains how you value assets for a subsidiary operating in a country whose entire leadership is acting like it dropped a bad tab of acid.

Great graphic in this article:

http://www.businessinsider.com/major-us-companies-face-billions-in-venezuela-currency-losses-2015-2

Ford pulled a Clorox, without saying it was leaving…

LikeLike

Why isnt the graphic in your link?

LikeLike

Good catch, thanks!

LikeLike

Wow. Schlumberger losing money in Venezuela… that has to be a threshold of some kind.

LikeLike

You do your work and you don’t get paid for it, you will lose money- even Shlumberger, which in its century of existence has had a pretty good profit margin.

LikeLike

A minor correction to make : “taken its Venezuela operations entirely off its U.S. books entirely”

LikeLike

thx, fixed!

LikeLike

This sentence is gold: “But, in the end, there’s no chapter in the little accounting handbook back at corporate HQ that explains how you value assets for a subsidiary operating in a country whose entire leadership is acting like it dropped a bad tab of acid.”

LikeLike

Pero es que, de pana, tu te quieres imaginar a los contadores de Pfizer tratando de interpretar la Memoria y Cuenta de Maduro?!

LikeLike

A unos execs ahí todos Wharton School en un piso 59 en downtown Manhattan tratando de entender, a través una línea de Skype que origina en CANTV y se corta cada 15 segundos, qué coño es lo que pasó con el Sicad2?!

LikeLike

Son escenas como de un picaresco surrealista caribeño que necesitarían los talentos de un híbrido entre Michael Lewis y Ryszard Kapuściński para echar el cuento bien echado…

LikeLike

It’s like an european client of mine who was puzzled on why its Venezuelan subsidiary couldn’t get a “solvencia laboral”. Isn’t their job to provide one, they said .

Or a friend of mine who, working at a large US multinational company, always complains to me that my country takes 80% of his time for 20% of their total revenues

LikeLike

Francisco,

With utmost respect, your tone and view of HQ workers is very condescending. I actually challenge your assumption; what is happening in Venezuela from an economic perspective is actually not that difficult to understand for people in HQ’s of large organisations. There are obvious motivations (i.e. end of year bonuses without clawbacks) for misrepresenting earnings, local currency reserves, etc. at lower exchange rates. I know very particular cases of organisations that have purposedly done so as it is rather easy to then blame it on the Govt’s incompetence and agressive policies toward the private sector. People in those organisations would probably not be held accountable for negligence but they should. If I were a majority shareholder of those organisations, I would be very dissapointed at vague excuses.

LikeLiked by 1 person

VennyT,

Without any false pretense of respect for your gleeful (and, I suspect, recently very much unprofitable) profiteering, I submit that if you’re finding it easy to explain to HQ that there are four exchange rates, which are actually 3, but one of which doesn’t exist yet and that all your money can be repatriated at any time but only illegally but that’s ok because every few weeks the president announces that he will imminently announce important changes to the legal route but then never actually announces it, then you’re…not dealing with a typical corporate HQ.

LikeLiked by 1 person

On 06/25/2014 FASB published issue No. 10-B that specifically deals with the subject of “Accounting for Multiple Foreign Currency Exchange Rates” (http://www.fasb.org/jsp/FASB/Document_C/DocumentPage&cid=1176157088122). In fact, believe it or not, this issue makes direct reference to Venezuela’s case. Any medium size corporation, multinational or not, don’t go by “little accounting handbooks” but instead follow FASB and GAAP guidelines to interpreter complicated matters. Anyone who has a minimum understanding of America’s corporate world knows that. Obviously you don’t.

LikeLike

Bueno, except you’re linking to a document that very explicitly explains that there are three different theories out there about how to deal with this situation (view A, view B and View C) , and none of them commands a clear consensus. It just says, in technical language, what I said in plain language: there is no plain rulebook.

TOMA TU TOMATE – didn’t think I’d actually read the link, didya? :D

LikeLike

“It just says, in technical language, what I said in plain language: there is no plain rulebook.”

You clearly haven’t read the article supplied by Ivan. This is a direct quote:

“Countries that do not have exchange controls generally have a single free mark

et exchange rate that is used to settle all foreign currency denominated transactions and remit dividends to foreign investors. However, countries that have exchange controls often have multiple exchange rates. Such is the case where governments mandate that foreign currencies (including U.S.dollars) needed to settle certain types of transactions may be obtained at a rate that is either favorable (a preference rate) or less favorable (a penalty rate) than the rate that would apply to other transactions, including a remittance of dividends to a foreign investor. For example, **a preference rate may be available to pay for imports of essential goods and services**, while a penalty rate would apply to pay for imports of what the foreign government consider”

Your article, Francisco, doesn’t take into account that “a preference rate may be available to pay for imports of essential goods and services”.

What “technical language” are you talking about?

Do you think anti-intellectualism cuts in the real world as it does in CC?

LikeLike

Well, I guess you are either missing or avoiding my point. There are concepts, principles and standards for financial reporting that in most cases are established by FASB and/or GAAP and anyone in the corporate world knows that. Sometimes they are vague, sometimes they are not. But if you are using “little accounting handbooks” to complete your financials statement you are screwed.

LikeLike

The problem as I understand it is not that accountants do not follow a specific set of rules, it’s that the rules the accountants follow are irrelevant because the usefulness of forecasts is based on some degree of predictability regarding government policy, which – at least to me – seems absent.

LikeLike

If you are a young person living/studying in Venezuela, this news would really depress you. With all of these western companies pulling-out of Venezuela there is little hope for the future. Venezuela is becoming increasingly isolated from the ‘real’ world. The young will suffer the most…

LikeLike

They’re not necessarily leaving. They’re just finally letting HQ in on the secret we’ve known all along: that all their profits are in monopoly money.

LikeLike

Yes, that’s true. But it will be a very long time before the manufacturing sector decides to re-open their facilities. The assets are still there, kind of, but without a real currency and exchange rate to deal with, there will be little incentive to move forward.

LikeLike

These assets, warehouses, administartive offices, factories, etc., will make great additional capacity for “Mision Vivienda”.

LikeLike

I understand that some transnationals are wary of abandoning Venezuela altogether beause there is always an expectation that things might change and return to normal allowing them good profits plus they know that returning to a place after you have abandoned it can be very difficult and costly and sometimes virtually impossible .

What they do is scale back their presence in the country to the basics , transfer abroad all the business they can ( including people) and use their non repatriable bs gains to build or buy urban assets ( offices and the like) that in time can retain their value .

For example if you left Chile with Allende and afterwards tried to get back and couldnt because mean while competitors had gotten hold of the market , youd think twice about abandoning your presence in a country that can in ordinary times be very profitable.

I think also that pyscholgically there is a common bias against recognizing a loss as final and definitive, this bias has been studied in the financial trade markets where people hold on to papers even if they are steadely and unstoppably losing money because to recognize that they ve lost their investment is too dicomfiting for them .

LikeLike

Agree with your analysis. I was perplexed as to why companies are still buying advertizing in Venezuela, when we don’t really care what the brand is, so long as we can find it. The answer is that they are very reluctant to abandon any market territory that has been captured. Even if their economic activity here is zilch, they won’t abandon the flag until forced to. It doesn’t cost them much to keep an office open, and they do think about the long-term.

LikeLike

Since a bunch of companies cannot repatriate its dividends, they see advertisement as a way to put in use its restricted and undervalued VEF.

LikeLike

That makes sense. Thanks!

LikeLike

Given that I can’t reply to you on your above reply, I will do so here. But, I have to say, you have to be quite childish to bring up this topic given that we are discussing a different matter. But well, Nemo impossiblia tenetur.

Francisco, you have demonstrated to not understand financial markets, at least emerging ones. And yes, I might be taking a hit on a mark-to-market basis, but that that doesn’t make the activity any less profitable in the long run if my assumptions are right (the way they have been for the past 15 years). On the contrary, current conditions and pricing of debt will actually make it very profitable provided that one takes the appropiate measures. And I am willing to risk significant capital in the pursuit of my ideas. I have my neck on the line, while you have nothing. And believe me, I am not going anywhere. I will be here in Feb. when juicy coupons get paid and you are proven wrong, in August, in Feb.’16, Aug.’16 and so forth and so forth. I won’t go anywhere if a default takes place. And actually, the risk of default is very much overstated (which has happened quite a few times in the past already). Perhaps you should talk to Luis Vicente Leon on this, who I don’t entirely agree with, but also share the same view in this particular point. The only difference is that I am willing to take risk on the back of my assumption. But given your language (i.e. profiteering, etc.) you are really not that different from Chavistas in power. In any case, at current levels, some of the shorter maturities (like PDVSA 8.5 2017) show a duration of little over 1 year. If a person believes that Venezuela and PDVSA do not have the money or commitment to keep current for 1 year, then it is probably a person who doesn’t know that 2+2 = 4. Zapatero a sus zapatos Francisco, zapatero a sus zapatos…

LikeLike

pidiendo peras al olmo, VT. Acaso no sabías que no hay nada, pero nada que este muchacho no sepa? Y aún cuando no está seguro de X, te lo envolverá en papel de seda – con lazo.

LikeLike

GM never expected to cash in the entirety of their assets at 6.5. They’re well aware, as any other importer, of the conditions on that exchange rate. It’s reserved for prioritary imports (so called productos regulados).

Because of that this article is near useless. You’re exploiting the fact that your average reader isn’t familiar with import protocol.

LikeLike

accountant here (if not practicing, at least I have the degree from a Vzlan university): to my understanding there is little these companies can do since both IFRS’s and national legislation prevent them from using an exchange rate in their books that is (a) illegal in Vzla and (b) hard to corroborate, such as whatever obscure websites publish.

a practicing CPA can surely correct me and/or add more current interpretations and practices in international accounting, but pretty much all these companies can do is wait for the unavoidable P&L hit, or at the most ‘pull a Ford’ and reduce the impact through non-operating provisions and separations.

LikeLike

Ford seems to me to be doing the right thing. Or as close to the right thing as circumstances allow.

LikeLike

yep, agreed.

I just wanted to add that little bit of insight before the doñadelcafetal-esque dichotomists inevitably start blabbing on about how treasury officials from multinational companies that have never used black market rates ‘le han hecho el juego a la dictadura’, and will now get what’s coming to them by legitimizing the government’s FX rate.

LikeLike

The actual US GAAP states that companies should report Bolivars in USD at the rate they are more likely to be able to repatriate dividends. Since SICAD I was supposed to be used to exactly that (in fact, i know from a good source that about nov. 2014 many companies received its dividends from the government at SICAD I rate), many companies are still reporting at SICAD I rate.

The companies are now awaiting for the different systems to be established (if any) to declare the FX loss/gain (more likely a huge loss depending on the rate).

The case of Ford is an interesting one indeed. More interesting was the case of Clorox whose shares rose ~9% the day it left Venezuela (Sept. 22nd) regardless of the actual state of its fixed assets, which were occupied by the workers as you may recall.

LikeLike

thanks for the additional info. I guess that besides CADIVI/CENCOEX and SICAD I, companies could also use SICAD II if they could in theory qualify for it (I admit I don’t know the rules for SICAD II) and the the new, yet-to-be-defined permuta model, but what they cannot do is refer to the black market rate in their books.

LikeLike

“Convenios cambiarios” explicitly allow juridical and natural entities, including foreigners, to participate in SICAD II since its inception.

LikeLike

You are right, but you are wrong too. Let me explin: You can pull a Ford, or you can pull a Clorox, or you can you use what accounting standards say, but you can also have the management assume that it will never get paid at Bs. 6.3 or Bs. 12 and maybe at Bs. 52 and take the hit as a reserve against what management believes it will happen. I have seen it done.

LikeLike

I think it is better to wait for the gov’t to devalue than to admit that your management misrepresented or made a mistake…

LikeLike

thanks for the additional info!

LikeLike

I suspect you’re right, miguel. I also know (without acctg training, but having worked for bank auditors at a then Big 8) that corporate accounting — with explanations — has some elasticity to it. So that, if your company’s reserves are healthy this year, and the building of plant facilities in Colombia are on target for 2016, you might want to take a hit regarding Vz losses this year, and subsequently adjust for the balance in 2016.

LikeLike

Ignorants and experts-du-jour which are plentiful in Venezuelan society can talk all they want about US Gaap, IFRS, etc. and find excuses to rationalise such actions or lack of action to righty put it.

A loss provision is what most of these companies should have done but didn’t, for reasons I previously described. It is accounting 101 (a topic which clearly many people here seem to have failed) and it can be traced back to ond of the basic accounting principles called “Conservatism”. All the rest are urban legends.

LikeLike

And these numbers don’t even include the intercompany debt… companies like MMC (Mitsubishi in Vnzla), Mondelez, and P&G have a huge exposure due to unpaid inventory.

I am amazed that AA is not included in this graph. Its total exposure is about USD 730 million valued at a FX varying from 4,30 Bs/$ to 12 Bs/$.

LikeLike

If I were Ford I’d call an astrphysicist to try and figuer out how to account for money you have in a another dimension. Sure, you’re making money, but you don’t know really how much it is and you don’t know when you’ll find a wormhole to send it back. The say there’s a wormhole that lands you in Cúcuta, but you lose a lot of your money. In special relativity, as you approach the speed of light your time and mass deviates from the frame of reference of people at rest. Venezuela seems a bit crazier than that.

LikeLike

LOL… Clever.

LikeLike

Hahaha…excellent!

LikeLike

I think the report is missing some biggies like Telefonica, American Airlines and BBVA.

LikeLike

It’s centered on an analysis of S&P500 companies, so that’s why there aren’t any European firms. About AA, I wondered too…

LikeLike

AA is listed on the NASDAQ.

LikeLike

Why is P&G listed twice in the chart?

LikeLike

Different reported Exchange Rate

LikeLike

A bit OT but: couldn’t the government keep SICAD I for 1) a ridiculously tiny amount of, say, medicines and 2) calculating the minimum wage even if this would be a complete farce?

LikeLike

They will continue calculating the minimum wage/GNP/etc. at 6.30–highest min wage in the Americas, Che.

LikeLike

I mentioned this scenario and its related issues about a year ago, starting twicein April, and again three months later in July. There was another post, but I forget where, dealing more or less with AA.

This isn’t news. This has just been…..overlooked. Being generous there, given the agent/principal relationship.

The number of footnotes in the 10Q/10Ks has been steadily increasing for those doing business in Venezuela. Metaphorical and otherwise.

LikeLike