Whoops. The gas subsidy still sucks, but this post was wrong. Explanation below.

Whoops. The gas subsidy still sucks, but this post was wrong. Explanation below.

Venezuelans have a hard time understanding the crazed extremes of mindless waste generated by our legendary gasoline subsidies. It’s not surprising: the policy is so multidimensionally insane, it’s hard to really take in all the different layers of destructiveness in one go.

In our public sphere, virtually no one fully “gets” the gas subsidy. Take the typical oppo retort to chavismo’s sudden decision to “revise the subsidy”.

“But they’re just going to steal the money we pay,” people say, “that’s not going to help at all!”

It’s worth sitting and puzzling through why this popular response is actually wrong. And it’s worth stopping to admire the scale of insanity the policy has reached: the gasoline subsidy is so crazy that even letting chavista enchufados steal all of the money earned from raising gas prices would better policy than what we’re doing now!

The basic reason is Juan’s old hobbyhorse: deadweight loss.

Deadweight loss is a bit counterintuitive, which is why so many public figures – even ones who should know better – biff it. But the gasoline subsidy’s main effect is not, as people often think, to redistribute value from poor to rich (though surely it does do that.) Its main effect is to destroy value outright by allowing transactions that should never have taken place – and would never have taken place, if prices had reflected relative scarcity – to take place, wasting resources.

In Venezuela, the deadweight loss arising from the gas subsidy been estimated at $10 billion per year. That’s in the neighbourhood of the cost of the Brazil 2014 World Cup, for reference, or twice the yearly worldwide budget of the World Food Programme.

That’s value that, at present, isn’t being stolen by anyone. It’s being destroyed. Outright waste.

Fully grasp that and you start to grasp the scale of the gas subsidy’s insanity: in economic terms, even if 100% of the gas price rise is stolen, raising the price of gas would still be better policy than keeping it at current levels!

Because money that’s stolen tends to be spent, and that generates value. It generates a multiplier effect. The money the crooked general spends on that 18-year-old scotch ends up in the liquor store owner’s pocket. Part of it goes to his employees, who spend it on groceries. Stolen money may be a catastrophically inefficient way to generate economic activity, but it will generate some activity.

But it goes beyond that: even if it generated zero activity – if all it was just ferreted abroad – it would be preferable to the wholesale destruction of economic value involved in the subsidy.

And, of course, raising the price of gas would tamp-down on the overconsumption that fouls the air and clogs up the traffic.

But that stuff is frosting. The cake is in stopping the wanton waste involved in the subsidy.

None of this, of course, is to say that the government is motivated by a concern with the waste of deadweight loss. Not at all! Surely their basic impetus here is to just balance the books. (Which, again, is not to deny that bits of the PDVSA bureaucracy must be licking its lips at the graft opportunities the increased take will generate.)

The point is that the economic effect of ending the gas subsidy is logically independent of the political motivation for doing so. In economic terms, the case in favor of ending the gas subsidy doesn’t actually have anything to do with what the government ends up spending its increased revenues on. And if you think it does, chances are you’re either pretty lousy at economics or pretty good at populist politics.

—

Update: A real economist has a rejoinder in the comments section.

The deadweight loss analysis is illustrating but, in my opinion, not quite right because the domestic gas market doesn’t feature a typical upward-slopping supply curve given the particular nature of this market in Venezuela. And that might be the reason why people fails to understand it in the case of the gas subsidy.

I think that a more appropriate, but somewhat similar, analysis goes as follows:

First, for simplicity, assume that PDVSA purchases all the gas in the international market to meet domestic demand. Define total surplus as consumer surplus (CS) minus the fiscal loss of supplying gas to the domestic market (FS = total demand of gas * (international gas price – domestic price)).

Consumer surplus is the typical one. What we need to do now is to see whether this total surplus increases with the domestic gas price. That is, we need to calculate (CS_1 – FL_1) – (CS_0 – FL_0), where the first term denotes the total surplus after the increase in gas prices and the second term is the total surplus at current prices. It easy to proof that this the variation is positive. Let’s try to do it graphically.

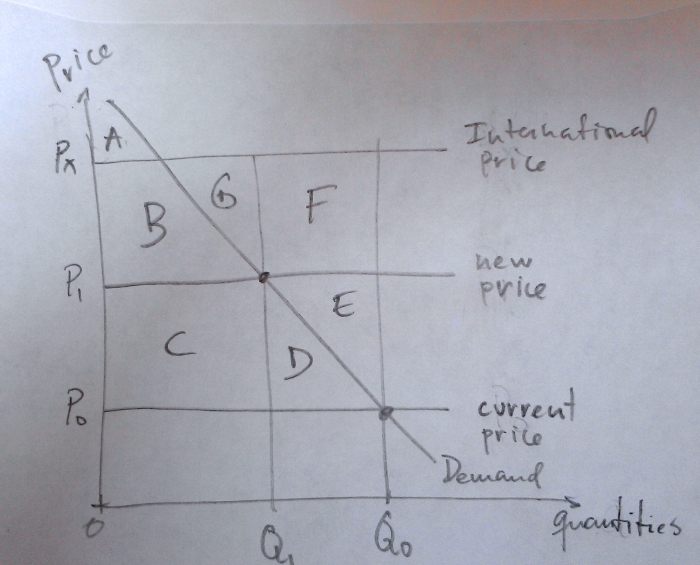

In the graph below, the vertical axis is the price level and the horizontal represents quantities.

The downward-slopping curve represented by asterisks is the domestic demand curve for gas.

The three horizontal lines represent price levels. The horizontal lines Q0 and Q1 denote the corresponding quantity demanded at each price P0 and P1.

We can now define areas delimited by the demand curve and the price and quantity lines. We denote each area with a letter (A to G).

Now we can define CS_0 = A+B+C+D, CS_1 = A+B, FL_0 = B+C+D+E+F+G, and FL_1 = B+G. Then, (CS_1 – FL_1) – (CS_0 – FL_0) = E+F.

This means that the drop in consumer surplus is more than offset by the fall in the fiscal loss. If the price were to increase all the way to international levels (Px), then the increase in total surplus would be E+F+G, which is the maximum attainable (assuming no negative externalities).

The intuition is very simple. With the ridiculously low gas prices, demand is quite high and we’re all paying for that in different ways: higher inflation as well as less and worse public goods. When the price increases, demand for gas drops and, as a result, the overall gas bill falls. Moreover, the associated negative externalities (traffic, polution, etc.) are reduced.

To conclude, what I think people ultimately fails to see is that they are paying for the gas subsidy in one way or another even if they don’t do it at the pump.

Manuel is too polite to say it, but this means the argument in my original post is wrong. Sorry!

Good attempt in trying to explain things for those who don’t want to see it.

Still, you will get some who will still say: “but I’d rather have these resources be destroyed than let Chavistas in any way profit from it – even indirectly by letting the whiskey-to-grocery-store-to-employees-to-empanada-vendor-effect take place. Better accelerate the whole collapse”.

A large part of our society, very sadly, would prefer to see the whole thing sink. They don’t see beyond that.

LikeLike

Two points to ponder on this question : 1st point, what size the subsidy , how do we calculate it .

There are three criteria for calculating the size of the subsidy :

1. the cost of producing one bl of gazoline is US$ 15 ( excluding gasoline component imports and payment of 30% royalty on the crude used to produce it ) and its sold at 10 Cents : , hence : net subsidy per bl is 14 dollars and 90 cents .

2. The cost of producing one bl of gazoline is US$ 15 , but royalties payable on the crude used to produce it are 30 dollars per bl and import of gasoline components average cost averages 50 cents per bl : hence : net subsidy per bl is 45 dollars and 40 cents ( 15 dollars (cost) + 30 dollars (royaty) + 50 cents ( imports) , minus 10 cents ( sale price) = 45 dollars and 40 cents ) .

3. bl of gasoline sold to export market 110 Dollars vs 10 cents sold to local market : selling gasoline at price different from what it would produce if sold at international prices would result in a total subsidy of 109 dollars and 90 cents .

Have we any idea which method of calculating the size of the subsidy we are talking about ??

2nd Point: If a person is hemorraghing from 4 different wounds 4 pints of blood per hour , and we staunch the hemorraghe from one of those wounds but arent staunching the blood flowing from the other three wounds , what is the relevance of staunching the hemorrague from that single wound . ?? in truth not much , the person will be equally death from the other three hemorraghes. in a few hours time .

Of course the staunching the fiscal hemorrague from at least part the gasoline subsidy ( depending on how you calculate that subsidy) is commendable , but by itself its pretty meaningless unless we look at the whole strategy which the regime intends using to try and balance the country’s dire financial situation .

The above considerations give us a clue of what an oppo politician should say if he is to give an honest appraisal of the regimes idea of raising gasoline prices .

Politics in a country where more than half of the population dont understand any complex economic issue and is simply in favour of that which benefits him the most short term is not kind to totally honest politicians , so what a pol should say which benefits his political position is something I cannot fanthom .!!

LikeLike

Any pol who jumps from this analysis to arguing “and therefore, we should NOT stanch the first of the four hemorrages” is really irresponsible, though…

LikeLike

BB,

I am relatively certain that the $12 billion estimated as the cost of the subsidy is only the bare production cost, and does not include the loss of opportunity costs.

LikeLike

“Politics in a country where more than half of the population don’t understand any complex economic issue…”

“More than half”? More like 99.99%.

LikeLike

The economic issue that most of the people understand in this country is “Screw everybody but me.”.

La idea de economía que entiende la mayoría de este país es “Jodan a todo el mundo menos a mí.”

LikeLike

“A large part of our society, very sadly, would prefer to see the whole thing sink.”

Is hard to not feel the temptation though. Besides 100% justified spite thanks to 15 years of the military mafiocracy, there’s the observable fact that chavistas tend to swap sides with more enthusiasm when they, personally, get screwed thanks to the regime.

And, you know, that they probable deserve most of it.

LikeLike

Quico,

I’m as critical of the Venezuelan gasoline subsidy as anyone but am somewhat dubious about the argument that, even if the revenue from a price increase were stolen, the multiplier effect could be beneficial for the nation’s economy.

I realize you’re using a dab of facetiousness to highlight the sillyness of defendig the status quo, but how do you square that argument against the one that the multiplier effect of the money people currently don’t spend on automotive fuel is just as, or possibly more, beneficial?

LikeLike

There is anther factor which needs to be considered. If and when gasoline prices are slowly raised throughout Venezuela, and as those prices approach the true market value, then the ability to make a profit through arbitrage on the black market sale of said gasoline becomes less and less. A very large portion of the Venezuelan population DEPENDS on gasoline arbitrage. As the internal economy of Venezuela has virtually collapsed, where do these people go to obtain an income? Arbitrage was/is their business. It is a very LARGE portion of this loopily constructed economy. Now what?

LikeLike

How about finding a productive way to make a living?

Also, you would also give less and less power to the Military/National Guard who are the ones that actually control the smuggling of gas. So its a win win for Venezuela Dr Buddy

LikeLike

Almost-free gasoline obviously causes overconsumption of gasoline, use of gasoline where some other method of travel might make more sense. So the basic point is solid.

But I don’t understand the idea that an increased price at the pump will generate economic activity.

You say: “Stolen money tends to be spent, and that generates economic activity.”

But money in consumers’ pockets, not-yet-stolen, tends also to be spent, and normally, at a greater rate for poorer individuals. That too generates economic activity.

So, my slogan would be: “No price increase for gas without monetary and economic reform!” They got the country into this; they should bear the political cost of economic mismanagement.

LikeLike

RT

Besides, the private individual is more efficient spending that money

LikeLike

Even as it is shown that the gains are greater than the losses, the point is still valid…

Basically, if you had to choose between this government having 3 oranges and the people having 2 what would you choose?

LikeLike

I think it’s more like: what would you prefer, to continue destroying one orange once a year, or to start letting the government steal one orange once a year?

LikeLike

The fact that there is no exchange in the gas market does not mean that the money not spent is destroyed…

I know you like formulas so, assume there are two goods in the world: gas and butter… what is not spent in gas is spent in butter… Dead weight loss is loss in THAT market not in the overall economy

LikeLike

It’s not that the unspent bolivar is somehow destroyed. It’s that the bolivar that *is* spent on gas destroys more economic value than it generates!

LikeLike

And where are you taking into account the economic value created by the extra cash that consumers now create in the butter market?

I understand that economic value is destroyed in the gas market, but this argument I think is worth having:

Is a dollar received by the government more or less productive than a dollar received by the consumer?

I think, mostly due to corruption and red tape, the value of the consumer dollar is higher than the value of the government dollar at least in THIS country and under THESE circumstances.

LikeLike

Gah, sorry I was pigheaded.

LikeLike

I just updated the main post to include Manuel’s comments + a legible chart. Thanks!!

LikeLike

I prefer the original article, even if it’s wrong.

LikeLike

That’s what people said about Chavez.

LikeLike

I think there are two fundamental problems with this absurd gas subsidy that are not often discussed. The first is that the subsidy prevents any fuel tax revenue from being collected. In most developed countries, fuel tax is used, at least partially, to maintain roads and other automotive related infrastructure and services. At least in theory. The result in Venezuela’s case is terrifying, crumbling roads, zero infrastructure growth, … The other big problem is that the subsidy massively distorts the way people use fuel, cars, and roads. By the way, there actually was a time in Venezuela when fuel economy was a factor in chosing a car.

LikeLike

Why would those funds be used for roads and infrastructure? Until recently, the problem was never funding. The problem was a wholly corrupt and incompetent governing party in charge of all the country’s financial resources.

LikeLike

Manuel´s right. The fact that you have a flat supply curve for gas implies that you have a dead weight “surplus” in favor of the consumer instead of a loss.

Manuel´s chart illustrate perfectly the dificulty is in terms of the political economy of rising gas prices: consumers (voters) gotta care only about consumer´s surplus. Fiscal losses are fine and everything but ain’t nobody got time for that s*it..

LikeLike

Not only that that the supply curve is flat but also that it’s demand that determines “supply”.

Your point about the political economy of the increase of gas prices is spot-on. Consumers are myopic, if you will, and do not seem to understand they ultimately do pay for the gas in one way or another. In consequence, they think that they are playing some sort of zero-sum game with the government.

There is another interpretation though. Even if consumers know that they are ultimately paying the overall gas bill, a rise in gas prices does relax the gov’t budget constraint. If you think that at least part of this additional gov’t resources are going to end up in PSUV’s hands and increase their chances to remain in power, then it’s natural that you oppose the gas price increase if you’re in the opposition. In this political circumstances, the government and (opposition) consumers are sorta playing a zero-sum game.

LikeLike

Very good point about the Oppo point of view being “zero-sum game”. But then, it is hard to imagine any sort of mutually beneficial compromise between the two sides.

The only country I can think of in which a government has liberalized the economy and stayed in power is China. Somehow, even if they wanted to (and I don’t think they do) I can’t see the Chavistas being able to execute that successfully.

So, that leaves the best hope for the Opposition in a catastrophic economic collapse that leaves the Chavistas unable to remain in power. If that is the goal, then the rational strategy for the Opposition is to lambast any attempt to incrementally liberalize the economy.

LikeLike

Francisco Toro,

I think you need to apply the very argument that you use for the stolen example to the current situation. That is, the money that goes into the subsidy also has effects that trickle through the economy. Lower gasoline prices means greater use of cars, which translates to more use of mechanics, who also spend on groceries, for example. Higher pollution and traffic stress also translate to more use of doctors and therapists, who also spend on groceries.

I keep pointing out that money flows; it does not disappear. The amount of money is less relevant than the points of entry into the system. Since trickling down of money is much less efficient and less evenly distributed than upward vacuuming, it is preferable to inject the money at the bottom, evenly, from where it gets sucked upwards very efficiently through consumer spending than to inject the money higher and expect it to trickle down, hoping it will bypass all points of corruption incentives.

Given the above, the comparison between injecting the amount of the gasoline subsidy into the subsidy versus it getting stolen becomes simple: which of those two alternatives injects the money into the economy in a manner that permits its flow more efficiently throughout the social network? In theory, the subsidy at least is injecting a greater percentage of the money within the Venezuelan borders than if it were stolen, which would tend to get hidden under foreign mattresses. What possibly brings the comparison of the two alternatives closer has to mostly to do with how much oil is being given away to foreign nations. If there were no giveaway, however, the subsidy would be better than the stealing.

Of course, giving the money directly, daily, and evenly to the people beats the above two alternatives.

—

LikeLike

I’m not economist, just a pedestrian…..if less private owned cars go to the road, how that person will get to work with the venezuelan public transport system? I foresee chaos!!

Can you give some light in this case?

LikeLike

I failed to understand both right and wrong explanations.

I could understand that stolen money can be somehow re-invested in the economy, wich would be good ,UNLESS, the boliburgoise put all of it into Caiman Islands accounts).

I also don’t get this “To conclude, what I think people ultimately fails to see is that they are paying for the gas subsidy in one way or another even if they don’t do it at the pump.”

if that’s true, then how can it be explained that prices of all products are expected to make a jump. A gas price increase would be a sort of tax hike then, everyone will also pay for the price increase.

What about the money lost to the insane subsidies to cuba and the caribbean? are we supposed to be OK with that?

The only solid argument I can easily understand is that an increase would make people use the gas in a more rational way.

LikeLike

The reason that free gas in necessary is political not economic. Free gas = tolerance for the unconscionable

Slum thinking: Let the stealing continue as long as they give us a piece of the game,,,Free gas is the only piece of the country’s wealth that the people are absolutely sure is not being stolen….

LikeLike

Hello,

I think the analysis done by your friend is not completely true. When you study prices, you have to consider “elasticity” of the good. In the case of gasoline, its demand is very “inelastic”. This means that when the price grows, the demand decrease only slightly. So, the line is not oblique, but almost a vertical line.

Also, the “externalities” should be considered with chopsticks. Increases in public transportation (private buses associations and cooperatives) are to be expected. When taken in consideration summed with the impact of the rest of macroeconomic changes that are coming, like the unification of the currency exchange rate, that will surely decrease or at least not increment the comsumption power of the least favored sectors of the population, the cualitative sign of the total externalities could, surely, be negative.

Regards,

-Gorka G LLona

LikeLike

It’s true that the price elasticity of demand do play a role. The more inelastic the demand is, the smaller the gains from rising gas prices. In the extreme case of a perfectly inelastic demand (vertical demand curve), the total surplus does not change when gas prices increase. This is, of course, abstracting from other considerations such as externalities. Now, as long as the demand curve is not vertical, there are gains from a gas price hike. I suspect that given the humongous gas bill that the gov’t pays, the gains from a price increase are going to be very large even if the demand for gas is inelastic, for which there seems to be empirical support. Some studies for other countries have found that in the short run an increase of 10% in the gas price lowers demand by about 2-3%, whereas in the long run it falls by about 6%.

Again, this analysis abstract from (negative) externalities. If we consider them, then the gains are even bigger.

LikeLike

An important consideration regarding the PED and studied price increases regarding gasoline: we are in relatively uncharted territory as far as the Venezuelan price change would go. A 10% increase in gasoline would still mean essentially free gasoline. I don’t think we can compare a 10%/2.5% short term change in a country where the price would still be free+10%. The PED for Venezuela is more or less indeterminate because there’s nothing to really compare it against; uncharted territory more or less.

To make significant inroads on the fiscal loss that the government is seeing, there would need to be a change along the lines of at least 100% at a bare minimum, and probably 200% or more.

But at that point, we are treading into what is feasible regarding the political economy once again.

LikeLike

The new price will likley not represent a total ellimination of the current subsidy but only a measured reduction in its size so as to minimize political backlash from the essuing inflationary effect, it might affect volumetric consumption but not dramatically unless the price hike is substantial. But the true impact will be where it helps improve Pdvsa s finances to the extent it diminishes its reliance on BCV having to print inorganic money to cover Pdvsa financial shortfalls and thus diminish the pressure on inflation . If overall inflation is reduced then the whole population will be the winners , There might be some gain also from a reduction of the incentive for contraband extraction to Colombia .

Private use of cars is likely affected by the fact that these are now in very short supply and highly expensive

, only priviledged enchufados and the military will get the trickle of chinese cars now being imported , the car park will slowly fall in numbers and people will have to rely on a an already overused and much deteriorated public transportation system . Imports of very expensive gasoline/ gasoline components from abroad which take a big bite from pdvsa finances might also be diminished helping square pdvsa much punished finances (refined product imports last year rose to some 10 billion dollars) .

LikeLike

“But the true impact will be where it helps improve Pdvsa s finances to the extent it diminishes its reliance on BCV having to print inorganic money to cover Pdvsa financial shortfalls and thus diminish the pressure on inflation…”

You forget that rising the gasoline prices will affect almost every single economic activity in the country where that price is a cost, resulting in way more inflation.

“… people will have to rely on a an already overused and much deteriorated public transportation system.”

People who managed to buy a car will never, ever go to use again the pile of useless shit that’s the public transport system, not only because it was an expensive shit before, but because it’ll be a even more expensive shit after the gasoline price rise (Transport unions are already asking to rise the passage prices to cover the gasoline cost, the same way they got to rise their prices at the same speed that the inflation rate, claiming that they didn’t have any money for parts)

Anyone could claim that there’s (or there could be) any subsidy to public transport to avoid getting inflation there, but there is already said subsidy, and yet the transport unions still do whatever they please with the routes and fares.

LikeLike

Ralph your are right in assumming tha the increase in gasoline prices will have an inmmediate inlfationary effect , but in the long run it will tend to taper off , in contrast the printing of money on a regular basis however has an incendiary and continuing effect on inflation so that at some point in time it might be better for the gasoline prices to climb to a level where the printing of money can be stopped or reduced than for the gas subsidy to continue indefinitely . Thats just a reasoned conjecture because the final effect depends on the size of the subsidy cut and other factors which we dont know anything about . for instance the govt might decide to use the money released from the cuts in gasoline subsidies to simply fund more wasteful social programs and keep the printing of money as before with nothing gained for the country.

The problem with private car use is that in time the size of the national car park will start to fall from lack of new cars to replace those that age makes obsolete or un-repairable from lack of parts so more people will have to use public transportation not because they want to but because there is no other choice.

We can safely predict that subsidization of public transport will become a huge source of corrupt transactions from which many enchufados will benefit

LikeLike