The Economic Commission for Latin America (CEPAL for its acronym in Spanish) published its Economic Survey of Latin America and the Caribbean 2014.

After downloading the report, the first thing we looked for were GDP growth estimates.

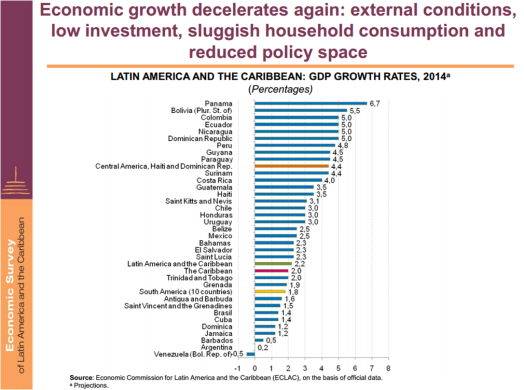

It’s sad, but not surprising, that Venezuela is the only country in the region that CEPAL expects to have a negative growth rate in 2014: -0.5%. This estimate matches the one from the International Monetary Fund (IMF) database (last updated on April 8th, 2014).

CEPAL says: “lower estimates of regional economic growth for 2014 are due to a number of factors. In some cases (Argentina and the Bolivarian Republic of Venezuela), figures for the first few months of 2014 reflect a deepening of the imbalances seen in recent years and the increasing risk that the growth of domestic economic activity will have to be adjusted in the light of the ability of these countries to fund domestic spending.” (Funny, they forgot to mention opposition protests and the “economic war” as the source of recession)

We must agree. Those “figures” have us all concerned.

The last of the recorded scarcity estimates reached 30%. When it comes to the scarcity index, we now depend on these types of leaks, because the Central Government decided not to publish it anymore. In the words of Merentes: “we do not want the index to turn into a political index that favor some and harms others”.

Even though we are still waiting for the official inflation numbers for June 2014, some sources claim it reached 5.5%, for a whopping 62.1% in one year. Venezuela’s 56.14% inflation rate last year was the highest in the world, and by the looks of it, Venezuela will win the golden medal once more: IMF estimates (last updated on April 8th, 2014) suggest Venezuela’s inflation will reach 75% by the end of 2014, followed far behind by the Islamic Republic of Iran with 24% and Sudan with 18.1%. And this is even before the rise in the price of gas.

And of course, we can’t forget about the ever growing monetary base.

According to CEPAL: “in the economies of South America (excluding the Bolivarian Republic of Venezuela) the monetary base grew far more slowly in the first quarter of 2014 than at year-end 2013 and the end of the first quarter of 2013 (…) In the Bolivarian Republic of Venezuela, the first few months of 2014 saw further marked expansion of the monetary base; by the end of the first quarter it had grown at an annualized rate (89.9%) that far outstripped the one recorded at the end of 2013 (65.7%). Substantial injections in the form of central bank loans to public enterprises, in particular Petróleos de Venezuela, S.A. (PDVSA), are the main reason for the sharply higher monetary base growth rate in 2013 and to date in 2014”.

And we can’t let go of this money-quote from Venezuela’s CEPAL report: “In 2014 the central government is expected to continue to run a fiscal deficit and to finance State-owned enterprises with loans from the central bank, given the expectation of an economic slowdown and a drop-off in oil revenues. Although the monetary adjustments are expected to yield some additional income in bolívares, these increases will be partially offset by an overall decline in oil revenues, since an increasing proportion of oil exports will be used to repay debts to China and to finance imports of food and other goods from countries that are beneficiaries under the PetroCaribe programme. A greater proportion of the deficit will therefore be debt-financed“.

***

We should clear something up…

The -0.5% rate seems kind of… well… not realistic enough, just as all members of the Caracas Chronicles family agree on.

Some sources linked to the Venezuelan Central Bank (BCV for its acronym in Spanish) say that Venezuela’s economy contracted 5.5% in the first quarter of 2014, while other BCV sources talk about a contraction of 4.5%. Econanalítica, a private consulting firm, estimated a contraction of 3% for the first quater of 2014.

In the midst of an oil boom we would expect a higher –or at least positive- growth rate. We’ll just have to keep hoping.

Thanks, ladies, for this Chronicle about a Recession Foretold. Now, as you said at the end, the -0.5% is rather über-mega-optimistic.

I would be interested to find out the average deviation of IMF/ECLAC forecasts for countries once recession sets in and real numbers are known. It is my impression these economists in those famous organisations are not more insightful than good empanada vendors in Venezuela, much less than economists with some brains closely linked to the country and not being paid by the government.

It would also be fascinating to read poll numbers about why Venezuela is in a recession…how many believe in an “economic war” and what their political position is. Above all: how more likely are people in Guárico or Trujillo to believe there is an economic war at all? These numbers might tell us a bit about what to expect in Q4 of 2015…if we have elections then, that is.

LikeLike

The Economist Intelligence Unit forecast a -2,5 for 2014

LikeLike

This is nit-picking, but while the hike in gasoline prices will cause generally higher prices for everything throughout the economy, that is not “inflation”. Ref.: Economics 101

LikeLike

I think you skipped that ECO101 lecture about inflation. Of course, it’s inflation, whether it’s one-time increase in overall prices or not. In the case of an increase in the price of gas, you’d expect the former (or something of that sort). Say that inflation is zero and the price of gas goes up today once and for all. You’d expect inflation to spike the following few months and then die out relatively quickly. How quickly inflation goes back to zero (or whatever it was before the rise in the price of gas) depends on some structural characteristics of the economy. Bottom line is that you would see a bump in inflation following a increase in gas prices.

LikeLike

Manuel,

“Inflation” is purely a monetary phenomena. When there are too many Bs. chasing too few goods, we get inflation. Inflation is managed by assuring that the money supply is equivalent to goods and services in the market. Inflation is one reason that prices go up. But there are other reasons for prices to fluctuate as well. In the case of the gasoline subsidy, when the price of gasoline is hiked suddenly, the price of all goods and services which utilize gasoline (or transport) will go up. In this case, virtually everything is affected by the price of gasoline, since everything is impacted by the cost of transportation. We will indeed see soaring price hikes of everything as a result. However, that is not inflation.

This is perhaps the most basic, yet most poorly understood, aspect of macroeconomics.

LikeLike

I think you’re barking up the wrong tree. It doesn’t matter what type of phenomenon inflation is or what causes it. Inflation has a very specific definition which you can look up yourself. And, please, don’t lecture me about macroeconomics. I sorta make my living off of that!

LikeLike

I agree Manuel. Price increases, structural or one-time, caused by monetary increases or not, are inflation. Famed economist Friedman postulated that the cause of ongoing price inflation over time is generally a monetary phenomenom–ironically, the Federal Reserve was created in the early 1930’s to control inflation, but has basically since its creation guarded against deflation by continually inflating the money supply/equivalents. Roy’s definition is supported by Webster’s, but I believe the price level is the key, regardless of what caused its rise.

LikeLike

Even though we are still waiting for the official inflation numbers for June 2014, some sources claim it reached 5.5%, for a whopping 62.1% in one year.

Not so. A monthly inflation rate of 5.5% will result in an annual inflation rate of 90.1%. Do the math: 1.055 to the 12th power= 1.901.

LikeLike

I think they meant the inflation rate for the year ending in June 2014, taking past imonthly inflation numbers together. I don’t think they mean to extrapolate.

LikeLike

That’s not how you calculate the 62.1% annual figure. For that you compare June 2014 CPI with June 2013’s.

LikeLike

There you go. I stand corrected.

LikeLike

The article at the link clearly states 62.1% inflation in the last 12 months. I stand corrected.

My corrected statement: “If the June 2014 inflation rate of 5.5% were to continue each month for a year, the inflation rate for June 2014-June 2015 would be 90.1%, compared with the June 2013-June 2014 annual inflation of 62.1%.”

LikeLike

“We will indeed see soaring price hikes of everything as a result. However, that is not inflation.”

One would have to think that “soaring price hikes” might indeed mean a rise in the consumer price index, one indicator of inflation. And they sure wouldn’t mean deflation…..

LikeLike

The reality is that Venezuela’s economy has experienced a dramatic slowdown since last year. Last year, according to unofficial estimates, GDP only grew 1.4%. In my opinion, this might be an optimistic estimate. For a reason, as far as I know, the BCV hasn’t released last year’s 4th quarter GDP figure. This year, GDP is will fall at least by what CEPAL and the IMF say. I’d say that it’s going to be more like (minus) 2-3%. This slowdown has come when public spending has reached record highs, according to a recent Barclays’ report. This report claims that during this year’s 2nd quarter, nominal public spending increased 135% when compared with the same period last year. Moreover, oil prices has remained high. They did dip a little at the end of 2013 but they came back up the last few months.

So the big question is why the economy has slowed down so dramatically, especially when we’re still riding an oil boom and the rest of the region (and pretty much the rest of the world) is doing well. The answer is pretty simple, I think: D I S T O R T I O N S! That is, government-created distortions such as the FX and price controls and the gas subsidy, which are the one we tend to talk about. The ones that hog our attention. But make no mistake, down the list of government distortions there are quite a few that may be causing as much harm as the Big 3. Just think of our insane labor regulations. The problem is that we don’t talk about these other issues enough.

The sad reality is that it doesn’t look like an opposition-led government would get rid of most of this “little” distortions that condemn the Venezuelan economy to underdevelopment. I guess that’s my pessimistic view.

LikeLike

This I agree with completely. There appears to be no stomach in Venezuela for fixing the fundamental problems in the economy. I too, am rather pessimistic, not just for the short term, but for the medium and long turn. Very sad when one thinks of what could be…

LikeLike

just a question..does one not need to have an economy b4 one has an economic war? ;)

LikeLike

Paging Mark Weisbrot.

LikeLike

As a reference: Norway had a GDP in Q1 of 0.5%

http://www.ssb.no/nasjonalregnskap-og-konjunkturer/statistikker/knr/kvartal/2014-05-20

That’s not a lot but we should consider Norwegians are not reproducing at the same rate as Venezuelans:

0.62% as opposed to 1.67%.

LikeLike

I have plotted the GDP growth of Venezuela, Nigeria and Norway across time several times.

A version pre-recession but that foresaw this:

The updated stuff will look more dramatic.

LikeLike

It will all be blamed on some nebulous conspiracy by Washington and its agents. The revolution is perfect and cannot fail. Marxist economic strategies embody perfection, right? And the 51% highly informed chavista voters of Venezuela will swallow it all hook, line, and sinker as they stand in line for 3 hours to buy bread and have to use cardboard boxes for coffins. I’m sure Mr. Weisbrot will have a good spin on it.

LikeLike

Pero, Chavistas tienen patria

LikeLike

La patria Venezola tiene residencia en La Habana.

LikeLike

Not casual but a very well executed master plan.

…get the most corruptible and least capable men to positions of power and decision making and rule the country down.

The poor will struggle fro food everyday and be too busy and too undernourished to fight back.

The middle classes will be the most affected , having their merit based careers and incomes crushed.

The wealthy will be either isolated (chavistas and non chavistas) or flee.

The state does not need productive citizens, just a clique of O&G workers to keep milking the cow.

As investment and development plans are not executed, they will run the fields and assets down and go on to sell out Citgo, etc. to keep the insane spending for a while.

Eventually, its all over!

either they move on to a next victim (cubans and other leeches!) or have caused so much destruction it easy for them to keep control on venezuela for a long ride.

I smile every time you commenters make statements like: “…his government has no idea how to control the economy”, ” The inflation is out of control, they should know better”, ” oh god they are running the economy down”

I hate to break it to you but they do! , and that is what THE plan is.

LikeLike

I agree with LuisF

The fight between radicals and pragmatics is a made for TV show, they have not moved an inch away from the plan to control Venezuela by destruction. El Plan de la Paria is really a Destruye pa que controles

LikeLike