Turns out my post on BCV’s falling reserves had some serious problems:

1. Our International Reserve figures aren’t like those published in normal countries. When Thailand, say, or País X report the international reserves their central banks hold, you have reasonable certainty that they’re reporting the full amount. Not here. The reserves number BCV publishes is better understood as a “greater than” than as an “equal to”.

The reason is the country’s off-budget black box funds, in particular Fonden, but also the Chinese Fund, and assorted other black-box accounts (que si el Fondo Alan, Fondo Renot y otras hierbas aromáticas).

We already know the public sector finances some of its imports directly from Fonden and from the Fondo Chino, without the money ever passing through the Central Bank. In important ways, then, these funds already operate exactly like parallel, secret BCV international reserve accounts. What we don’t know is how much money is involved, or when it’s spent, or what their balance is at any given point.

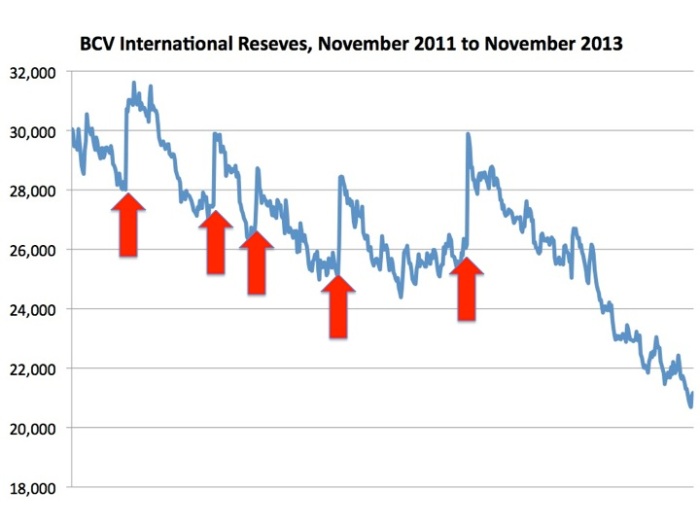

The relationship between BCV Reserves and the black box funds is complicated and exceedingly opaque. You can see what I mean if you look carefully at the chart I published yesterday:

There are five sharp spikes in the chart, when the BCV’s official reserve figures jump up suddenly. What the heck are those?!

There are five sharp spikes in the chart, when the BCV’s official reserve figures jump up suddenly. What the heck are those?!

Some of them seem to be transfers from Fonden (and other nether-funds) into BCV Reserves. Others are apparently discretional transfers into BCV Reserves from PDVSA, carried out just before the cut-off date to calculate the next period’s level of “excess reserves” (i.e., reserves that can be transferred back out to Fonden.)

In other words, there’s a complicated dance between all these pots of money, and it’s not easy to discern the logic behind it. For instance, even this year, with the value of reserves in free fall, BCV transferred $3 bn. in “excess” reserves to Fonden!

Perhaps the better way to think of all this is that there are lots of communicating vessels between a declared portion of International Reserves that are held by the Central Bank and an undeclared portion of International Reserves spread through a dozen highly opaque pots of money outside BCV’s direct control. It’s exactly as orthodox a way of managing your reserve assets as you’d expect from the clowns who now pullulate around Carmelitas.

This strange situation makes standard analysis of reserve levels highly problematic. Sure, there have been various valiant attempts to reconstruct Fonden’s balances on what amounts to the backs of more-or-less-sophisticated envelopes, but the limitations to those kinds of exercise are obvious.

With no balance sheets, no audits, no paper trail and no accountability at all, there’s just no telling how much of that money is now ferreted away in Jerarcas Rojos’ discrete Cayman Island accounts, to name just one obvious possibility.

Fact is, we just don’t know how much money is left in the undeclared portion of foreign reserves. So we can’t really tell whether overall reserve position is going up or down or sideways. All we can say for sure is that they’re no-less-than a number that has been falling this year.

2. The fall in the value of the declared portion of reserves this year is, to a startling extent, just a function of the falling price in gold. Gold, lest we forget, has made up the lion’s shared of declared portion of reserves for years now.

In a way, the declared portion of BCV Reserves has been remarkably stable for the last couple of years: they have about $4 bn. in IMF Special Drawing Rights, 336 metric tonnes of gold and a liquid portion somewhere between $1 and $5 billion. The biggest slice by far is the gold, though, and gold prices have fallen a lot this year, which is why the value of declared reserves has been going down so fast. But that’s very different from saying that reserves have been falling because BCV has been dishing out more and more dollars.

It may be that the implicit rule Giordani’s been following all along is fairly simple: declare your gold reserves, declare your SDRs (porque ¡ni modo!) and declare about $1-5 billion of the rest of your reserves, but no more. If the liquid portion of declared reserves starts to challenge that band, shift a bit of cash to or from the undeclared portion to bring it back within range. That’s it.

The punchline here is that it’s probably not a good idea to place too much analytic emphasis on the not-less-than number that BCV declares as its International Reserve position. Truth is, our overall reserve position might be falling fast, or it might be holding steady, or it might be rising.

We don’t know, because they don’t tell us.

You know who cares about Venezuela indicators? Wire service news administrators love indicators. They compete to get them first and have them accurately on the wire before the competition. It’s a fetish for them.

LikeLike

I know!

It really is remarkable that it hasn’t leaked after all these years. I mean, it’s *valuable* data. A bond trader with a detailed undeclared reserves spreadsheet could make a *lot* of money.

In a country where everything always leaks, I think this means only one thing. VERY few people have access to this data. Like fewer than 10. Few enough that one mistimed plane accident could wipe out any trace of institutional memory.

Otherwise the buhoneros on the autopista would’ve been hawking it years ago, no?

LikeLike

It certainly is curious if they have so much in alternate funds why they would consider selling a ton of gold.

To the average man this is not a good sign &, I would think, not a good political move.

I personally think that the amount available to them in alternate funds is much less than people think. Time will tell.

LikeLike

Agreed. If you are going to sell gold, why sell when it’s just dropped from 1600 to 1250 per ounce? There are just too many indicators that the gov is not flush with cash.

LikeLike

I agree.

LikeLike

While a precise calculation maybe impossible because of the profussion of govt funds and the lack of information on how they fare any given point in time , we do know that Pdvsa controlled funds are insufficient to allow it to cover its costs and commitments , thus the arrangements whereby the BCV covers its deficits with inorganic money , its failure to pay contractors their goods and services and its failure to pay its joint ventures the price of the oil which it buys from them so that they can not pay their partners any dividends and must resort to future oil delivery mortgages to attract their investments to simply maintain current production or recover lost production . We can easily surmise that any funds handled by Pdvsa are heavily depleted. The Chinese fund contains one part which is dedicated to fund ongoing projects on a continous basis and while it is not impossible that these funding is sometimes interrupted leaving the projects on hold , to use the money on other more pressing items it isnt simple to merely stop these projects on their tracks , remember many of these projects are performed by chinese contractors who dont take kindly to being left unpaid. (also their local associates which include companies with heavy govt big wig representation ) . Fondem equally is dedicated to the funding of ongoing projects so in these cases we are not talking about foreign currency funds which are easily transferrable from one use to another , it can be done but the effect can be disastrous making the projects much more expensive to carry through ( interrupted projects balloon in cost ) , Another part of the chinese funds are held by chinese banks as a buffer to ensure payment of future loan installments ( and are thus not recieved by Pdvsa) , Chinese authorities would have to be asked to forego this financial protection to make such buffer funds available to the govt, which not always easy. ( Chinese capitalism can be as heavy handed as western capitalism) .

So although no precise picture on the BoP situation can be drawn from the study of Venezuelas foreign reserves it is clear that its not doing well , there are too many signs of that , how badly we cant tell !!

LikeLike

I just think there’s so much wishful thinking/potentially wrong with this kind of reasoning. Take PDVSA. Would a sane oil company hang on to a stash of several billion dollars all while stiffing key suppliers and failing to maintain key production areas? Of course not. But are we really so sure PDVSA is run even minimally sanely?

I’m not at all. I wouldn’t put it past Ramírez at all to do this in some misguided attempt to maintain his own options in cabinet power games. Who knows!?

Same for Fonden. If you had any confidence that it was run by people basically interested in making its projects run smoothly, then yeah, probably they wouldn’t agree to defund them suddenly throwing everything into sheer confusion. But these are chavistas we’re talking about! Throwing everything into sheer confusion is what they’re all about!

So I just don’t place any store in this kind of kremlinology. We’re not dealing with a leadership clique whose behaviour can be predicted through this type of inference.

LikeLike

Contractors who dont get paid stop providing services , suppliers who dont get paid stop delivering their goods , joint venture partners who dont get their dividends stop investing , the end result: declining oil production which means less money to keep the system going . Some projects can get held up but sooner or later they have to be advanced (at a much higher cost), others you hold up at your peril ( refinery upkeep and upgrading expansion) . the Chinese dont advance money on the funds unless the are covered 100% with future oil production . Ramirez can fiddle a bit with the funds but there are restraints . The whole system is fueled with oil production and this doesnt stand still , once it reaches a certain stage it starts stagnating and falling at an increasingly precipitous rate unless you invest to keep it going. Kreminology is for guys who have no idea whats going on inside the kremlim . But Pdvsa leaks (even if not macro financial) tell a story that cant be missed . Ramirez has for years gratified Chavez whims giving up money needed for inside operations , now Chavez is dead and the operational needs have grown to a level where they can no longer be postponed . People may be irrational in their pursuit of absolute power but they are not often suicidal.!! There is money in the till , but it probably is not as much as people might think. !!

LikeLike

Bill Bass summarizes the fragile financial situation of the country very well. What is important to notice is that this chaotic financial management has prevailed for many years without Venezuelan citizens calling the government to task, meekly accepting this disaster. What would have been unthinkable before this regime came into power is now accepted practice. More than a failed regime this is the collapse of a country that does not have enough defenders.

LikeLike

If I were an opposition candidate I would make a big deal about lack of transparency …show us where the money is! It is outrageous that these things are treated as a state secret.

LikeLike

I imagine the conversation between Chavismo and El Pueblo would go a little like this…

LikeLike

If we evaluate the financial and political manuevering of a leaderless political party in a Latin America country such as Venezuela through the lens of Western values we will never understand their agenda. We have to put ourselves in the shoes of a Caracas street hustler trying to make a profit from buying “dolares” on a day to day basis. The Chavez regime as it remains is only interested in wealth capture by capturing as much “raspadito” until the day they must flee. It is the only conclusion anyone can really deduct given their actions, short-sightedness and “mis-management” of funds and government. Those at top don’t care for Chavez’s agreements and finishing projects. They don’t care for the responsibility they have to their people. We would hope that the opposition might be able to utilitize the ineptitude from the “Chavezites” but the poor havent been hurt enough to cause any pushback. The tolerance of the poor is very high given that they have always been without so what’s the difference between those in power and those who were? The middle class are the only one’s who have gotten hurt and their numbers are not enough to create any kind of fearful uproar. The revolution has been nothing more than the biggest redistribution of wealth from those few who had it to another few who didn’t have it……If I was a bond holder of Venezuelan debt the clock is ticking to the day when the music stops and those holding debt will be left with no chair.

LikeLike

Is there a way to visualize the possible maximum amount of money the government can have in the best case scenario and otherwise? I mean: it is not like the government can generate money from previously unseen resources…unless you are talking about cocaine or selling directly diamonds or the like…which I doubt the government would do (something else if the military do that for their own personal accounts).

LikeLike

Now that is an interesting question.

Can we assume the most public number is the highest of the accounts? If that is the case then even I can do the math. If the BCV number is not the largest, then who knows?

LikeLike

The piece points to some ingenious attempts to reconstruct balances based on bits and bobs of public data. They’re…better than nothing, I suppose – the consensus figure on Wall Street seems to be $15 billion or so – but who knows?

LikeLike

You raise a good point. However, the level of unconventional reserves spread around is unprecedented. For instance, even though it is not a huge amount, did you know that some of the countries that pay the govt. with food for the oil they receive (Petrocaribe, etc) deposit cash in accounts in favour of PDVSA because PDVSA has the option to decline payment in say grains or fruits if they’d want to?

That being said, in a normal scenario in a normal economy, the Govt. should publish reports indicating where the funds are invested and what assets they are holding. There are many great examples: the Swedish, Norwegian and Danish pension and sovereign wealth funds for instance. But then again, this is one of the hundred of things that Venezuelans seem not to care about.

LikeLike

“Unconventional Reserves”

I like that a lot, mainly because I am suddenly better off than I suspected. I have six 100 year Live Oaks ‘ya see….. :)

LikeLike

I’m curious… Are all these Fonden and other assorted groserias… Stuff that we got while Chavez was in power? Or did some of it start during other periods?

As far as I can remember we have always had what seemed to me like improvised quirky stuff going on, including control de cambios (til CAP?), various populist and corruption-enabling spigots, chaos, anarchy, and lo que les daba la gana. But I’m no economist or historian, so you tell me.

If the opposition gains power, I’m not certain that a lot of these ways of running (ruining?) the country will disappear. It’s sad.

LikeLike

I am curious as well. People seem easily to accept the notion that the government they elect should know things they don’t about their finances. I don’t know where these masters in the regime got their paternalistic worldview but it seems to run deep and it does not strike me as being very ‘revolutionary’.

LikeLike

Well, we had FIV, and FIEM, but they did not make a big secret about their balances. As far as I know the secrecy surrounding the Chávez era funds is unprecedented.

LikeLike

And in the past the FIV went through the formal budget process, as any other government spent.

Now the All the funds and PDVSA are running discretionary spend levels much higher than the official budget without any controls … but I guess it is obvious if you want big corruption without consequences you need to have a way of spending while circumventing the official controls.

LikeLike

“…they have about $4 bn. in IMF Special Drawing Rights, ”

There’s your real problem. To acquire such “rights” from the IMF Venezuela must have been required to have verifiable and periodic audits. Right? How can Venezuela have the “right” to draw emergency funds yet hide from the IMF critical financial data which is CAUSING the emergency? Someone is getting bamboozled here. Why are they even members of the IMF in the first place?

LikeLike

My guess – someone correct me if I’m wrong – is that it’s a legacy thing. Those SDRs were allocated to Venezuela long before the Chávez era started. It’s not like IMF can turn around later and un-allocate them if you start twiddling your figures.

One thing, though, you’re very clearly right about: Someone is getting bamboozled here.

Just look in the mirror…

LikeLike

Quico, would be interesting to get some analysis/views on how all of this is possible, thanks to the international infrastructure that facilitates the stashing away of funds….not to declare we have no responsibility for what happens in our country, but I feel that as the ‘camion volcado’ story highlighted the other day, too many people are making money out of this (there is an international constituency profiting from our mess and it gets stronger by the day….until the day a failed state turns into something really dangerous…only then)

LikeLike

Now I understand why economists use the term “funny money.”

LikeLike

OT

El Poder de Uno by JJ Rendon: http://goo.gl/MpJ16f (turn off music in upper left corner)

Blog in spanish: http://goo.gl/iTvdGO

LikeLike

Bottom line, no country normally historically, even if badly managed, sells their gold, unless they’re “raspando la olla”. Similarly, no country would let the parallel rate , which determines much of the local inflation, skyrocket if there were excess dollars which could be used to lower it on a sustained basis. So, I wouldn’t put much stock in rumors of hidden excess reserves in Fonden, PDVSA, or wherever….

LikeLike

Dear Francisco,

you didn’t hear this from me ;) but I’d say that the declared International Reserves represents most accurately the sum of cash and other assets that the Venezuelan state can use as it sees appropiate on any given moment, and the one which is readily available for FX purposes.

Most of the funds on these ‘parallel’ institutions are either earmarked, or invested in money market and fixed income instruments. And these investments guarantee the viability of Bandes, FCCV and Fonden, because they are self-sustained, have significant payroll and administrative expenses, and very little other sources of income (they don’t make loans for development purposes, they just disburse cash for the earmarked projects/imports without expecting a repayment).

The sudden spikes in the indicator represent the times of year when these institutions perform what is called a ‘Cesión de Cartera’ (Portfolio transfer), which basically means that these funds have to transfer all of most of the aforementioned instruments to the BCV. The part that doesn’t get transferred is kept to sustain the institutions.

LikeLike

OK, you clearly have a more sophisticated grasp of these dynamics than I do…but doesn’t your final paragraph directly negate your opening paragraph?!??

LikeLike

Well, maybe it does, and you are right for pointing that out. I guess my only argument is that the institutional dynamics in play are not that simple, and they ultimately are guided mostly by discretionary authority. So your point stands: the declared level of International Reserves is a variable that the government handles as it pleases.

What i can tell you is that the realized decline in International Reserves is real (not only on the declared portion), the portfolio transfer this year is going to be much lower (Fonden and other funds had their FX funding severly cut this year, and the outstanding FCCV’s funds are being earmarked to the penny by the Chinese), and it will not compensate for the $9bn decline we have seen in 2013. The reasons for that have been laid in different points of view by you, BoFA’s Rodriguez, and Distortioland’s Omar Z.

LikeLike

Btw, neither of this is insider information (i wish i had it, of course, for bond trading purposes ;D). This is just straight out of Bloomberg News.

LikeLike

The real question for me is:

Is the *overall* (declared + undeclared) International Reserve position being depleted in order to help absorb some of the monetary imbalance Distortioland underlines? Or is the entire impact of monetary imbalance being passed through to inflation/scarcity?

I don’t think we can really answer that with the information we have.

LikeLike

p.s., I’d love it if you wrote a guest post on this stuff – you’re clearly immersed in this debate in a way I only wish I was. Interested? caracaschronicles at google dot com

LikeLike

how much of that money is now ferreted away in Jerarcas Rojos’ discreet Cayman Island accounts…

ITYM “squirreled away”.

Ferrets hunt and find things, which are “ferreted out”.

Squirrels accumulate stockpiles of seeds and nuts for the winter, which are “squirreled away”.

In this case, los Jerarcas Rojos have “squirreled away” much loot in the Cayman Islands. Come the Revolution, these funds will be “ferreted out” by forensic accountants (one hopes).

LikeLike

Well said. Animal idioms are tricky. I will use both woids in a sentence…….

In time Venezuela will need a vicious Ferret from Angry Auditors Inc. to ferret out the cash that the Chavistas have squirreled away. I’ll wager the Chavistas will be Ratted out.

LikeLike

FONDEN is now also being used for SICAD, among other things.

Could it be possible that some part of FONDEN is also being used for such things as securities to our $4.4 billion loan to buy Russian weapons and the Chinese fund etc?

According to official Russian documents the Venezuelan government has 49.9999% of shares in Еврофинанс Моснарбанк (Evrofinans Mosnarbank) and the total capital of the bank would be about 4 billion dollars. In some of those documents I saw that the main purpose of the bank was to facilitate the purchases of weapons. FONDEN is explicitly mentioned there as source of Venezuelan payments.

LikeLike

I was indeed wondering what those spikes might be all about….

Does it tell you anything that the spikes have become absent or hardly noriceable in the past year or so? One interpretation is that the other accounts are tight, there isn’t much left to transfer, and therefore what you see in that graph really is the unallocated (discretionary) portion of reserves. These guys wouldn’t be getting so worked up about a splashy newspaper story if they could just right out and say, that’s bull and here are the numbers to prove it … Sounds to me like they are in a bind.

LikeLike

Does it tell you anything that the spikes have become absent or hardly noriceable in the past year or so?

Yes, it’s information… but what to make of it?

I’ll bet your last sentence covers. But I want the odds….

LikeLike

Closely related is the uncertainty surrounding the “M2/Reserves” indicator.

…But what we know for certain, is that uncertainty has a price.

LikeLike

It may be not to the point. But wasn’t Francisco Rodriguez from BofA one of Giordanni’s minions?

LikeLike

I don’t think that copy pasting from other websites adds that much value to a discussion unless 90% of the people have exactly the same view on something. Diversity and different approaches on a given topic are beneficial to any serious discussion. Hopefully I won’t get satanised (again) by the specialist-du-jours. Let’s look at some very reasonable comments written by Walter Molano today Nov. 25th of 2013. I don’t agree entirely with Molano’s view on Venezuela’s current account surplus but I would say that overall, the below arguments are reasonable as opposed to some of the “Disneyland/Mickey Mouse comments” I normally come across regarding the country’s financial matters:

Venezuela’s economic and political situation is not idyllic. It must be a tough place to live, but the country is in no threat of imminent default. On the contrary, Venezuela’s credit situation is comfortable and improving. The new PDVSA ’26 issue is being used to offset the amortization of the PDVSA ’13s, plus generating additional funds for the central bank to use in its SICAD program. Given that much of the new issue went into government agencies that were already holding the PDVSA ‘13s, it was a virtual rolling over the debt. Many analysts and investors were concerned by the large decline in international reserves. They fell by a third this year, and more than two-thirds of its international reserves are in gold bullion. Ever since the repatriation of the gold, many people have had doubts about its whereabouts. Yet, with a current account surplus of $3.2 billion during the first half of the year and a forecasted surplus of 3.5% of GDP for the entire year, it does not look like the country will face any major shortfall. The Venezuelan government and PDVSA have a combined maturity of $4.5 billion next year, and a total debt service of more than $20 billion. Yet, $16 billion of the obligations is for debts owed to service providers. The total stock of sovereign and PDVSA foreign obligations is $80 billion, with roughly $40 billion each—which pales in comparison to the country’s $382 billion in national output. Moreover, the government has ample non-reserve assets, such as Petrocaribe, FONDEN and several other government funds that can be used to service external obligation

It is pretty clear that the government does not want to do anything to jeopardize the foreign direct investment (FDI) that is flowing into the Orinoco Belt. The government hopes that new project will increase daily production to 4 million barrels per day (bpd). Production in 2014 is slated for 3.1 mpd, up from 2.7 mpd last year. This is Maduro’s only hope of retaining power. If he is able to generate enough resources to keep his populist policies alive, he can cling on for a long time. Therefore, Venezuela is compensating investors for the risk they are taking. It is also demonstrating that it has the capability and willingness to service its debt. The place may be a mess, but the rewards are interesting as well.

LikeLike

It would be interesting to note how your assessment might change if there were to be a significant drop in oil prices, for instance as may occur if iran and the usa reach a broader deal: http://www.nytimes.com/2013/11/26/business/international/oil-prices-dip-after-nuclear-deal-with-iran.html?ref=world

A 15% increase in production may not suffice if venezuelan barrel loses 15$ or more….

LikeLike

Very good point Gro.

As I said in one of my replies a few days ago, what opposition and people in general should be constantly bringing up and thinking about is about the revenue side of things (derived mainly from oil & gas). This is what ultimately and has always determined Venezuela’s path. Of course, cost management is a fundamental part of any economic model, but it is also important to remember that a country is not a company. Hence, when debating financial issues about Venezuela and PDVSA, there is always some flexibility and blurriness around the arguments and it is not always entirely clear what the limitations in terms of cash flows are.

However, people tend to be obsessed by the cost side of running the country (public expenditures, imports, etc.) when it is more than evident that this part of the system is easier to control in a scenario of financial pressure given the lack of standards of the Venezuelan population as a whole.

I follow closely the news and research on alternative energy sources, current supply of oil, etc. and at the moment my assessment is still the same. Someone investing in Venezuela/PDVSA bonds is by large taking a view on oil prices. In the past, Venezuela/PDVSA have been under equal or even greater pressure in terms of oil prices and still kept solvent. I am confident that this will still be the case going forward. There is always the risk of the emergence of alternative energy sources or new drilling methods being discovered that could like to a large decline in oil prices (~40-80%, similar to what happened to the price of Gas due to shale drilling), and that is what one is ultimately exposed to. Govt. actions will determine whether the country is either less or more protected in such a scenario. If you ask me, Venezuela is relatively unprotected but I also think the probability of such a large decrease in the price of oil is low at this stage for reasons we can go into later.

In a worst case scenario, the govt. will most likely take other measures (more inflation and printing of local currency, monetization of local debt, further devaluations, less imports, less subsidies) before considering a default. We have still a looooong way to go if we look at all the measures the govt. could take. Defaulting is the equivalent of saying: “well, I will kill myself because I need to lose a leg”. It’s just suicide. It’s funny how people always talk about how dependent we are on oil but fail to take a deep look at the implications of this. If Venezuela/PDVSA were to default, do you still think the country will be able to export oil successfully without being subject to creditors seizing oil shipments abroad? It is very likely that Venezuela/PDVSA will not be able to keep exporting like it currently does because a large number of creditors will end up chasing their boats and oil shipments around the globe. This would stop the mechanism via which the government monetises the golden eggs laid by the goose. Default = oil revenues at risk of being seized. If you think about past defaults, Argentina or Ecuador are not Venezuela. Our economic dynamics are significantly different, none of them export as much oil as we do and import everything they consume.

LikeLike

And apologies for the lack of spaces! My browser seems to not recognise these.

LikeLike

Venny: Oil is sold with title passing to buyer at the Venezuelan port of Shipment , Pdvsa owns none of the oil it exports . creditors would have to go for the bank accounts and other assets ( Citgo) to recover their money . The govt has placed its bank accounts in jurisdictions and under conditions that are not easily within reach of private creditors . Default is a problem but not impossible !! Whats missing form most of the above comments is that they are all views from outside the whale , no one knows whats it like inside , I suspect that people inside are not as confident as you are or as the regime leaders declare. The key is disposable oil income which a function not only of prices but of production which is in dire threat of falling , refining capacity ( which at an all time low) , rising import needs , mortaged future oil ncome streams . need to fund balloning social programs , subsidies , clientelar patronages , the cost of constant operational and planning blunders and corruption which you wouldnt believe . Rosy coloured spectacles help interpret things in a way that assuages ones fears , makes credible the incredible , the fact is Venezuelas fate hinges not on the decisions of people acting rationally , but of people blundering their way through a storm they cannot control .

LikeLike

Bill,

Do you think the buyers of that oil will not be subject to tremendous pressure from the international financial community in case of a default? What about the credit lines of banks which process the credit notes for importing everything consumed in Venezuela? Do you think foreign counterparty banks will just disregard such a large default? By the way, there have been instances in the past where tankers from defaulted countries have been seized in the middle of the sea by very well-advised hedge funds, a famous case is that of the seizure of tanker called Nordic Hawk in 2005 carrying $39mm in oil shipments which were ultimately linked to the Republic of Congo. This country had defaulted on its debt and then was chased down by a fund until it ultimately had to settle.

There are other precedents of tankers seized in the middle of the sea, regardless of the contract specifying that the oil doesn´t belong to Venezuela. There is always a money trail. By the way, more and more countries are being forced to disclose the holders of bank accounts due to U.S. Tax regulation like FATCA and other laws which will come in the future. You only have to look at what happened to the U.S. citizens holding accounts in Switzerland. The world is moving towards more and more transparency in terms of taxes which implies transparency in the banking system.

Last but not least, it still surprises that you still catalogue imports and social programas as a fixed cost? Really, do you think the govt. will think twice before ending some of this programs? Look already what is happening to Petrocaribe, or some of the Barrio Adentro module closed down, etc. All this can always be scaled down because the large majority of Venezuelans have such a low standard of living that they are easily manipulable,

LikeLike

Gosh Vinnie the idea of a default really touches your nerves !! I too feel a default is deplorable and can have all kind of consequences , Still the law is the law and whatever isolated cases you cite the general rule is that you cant seize property that does not belong to your creditors . Lawyers are going to have a field day but that avenue of attack has its limitations . If the law was so clear why hasnt Pdvsa had any of its exported cargoes seized by any of its many disgruntled creditors , Its not so easy my friend !! Venezuela even as we speak has taken measures to protect its offshore income , cant tell you how they do it , but they have some pretty clever bankers and lawyers and friendly countries doing that work for them . Youd be surprised!! . There are many ways in which these default situations are handled , some defaults are partial , some creditors dont know it but there are miriad of legal holes which might make their paper legally suspect. Most creditors just want a deal that saves them a headache in a situation where they find it difficult to get at their money in competition with hundreds and thousands of other creditors.!! Almost always its every man for himself , the bigger the default the bigger the incentive to negotiate a settlement . The chinese have their loans covered , would they care about what happens to the rest ??

About the treatment of social programs and some imports as variable costs , you dont know the mindset of our rulers, they are howling crazed by Power and power means retaining some level of popularity before they become so unpopular that someone is tempted tp push them aside . Dont count on their treating their core constituency as they treat some tin pot govts in the caribbean . Even the poor in Venezuela have become accostumed to some creature comforts that the poor of other countries dont dream about , Consumerism is as rife among Venezuelan poor as visitors to any Miami shopping mall. Didnt you see the big throngs before the doors of the tv appliance shops. At a time in which even the EU banking system and govts have been close to default , you are awfully nervous about the possibility !! Any country can default and the world rushes to avoid the default becoming a catastrophe , specially when it affects the worlds oil supply !!

LikeLike

Hi Bill,

Not upset at all. It doesn’t touch my nerves, it is the same view I’ve held for the last 14 years amid oil strikes, coups, financial crises, etc. Venezuela has been in much worse places financially speaking in the past (3 months oil strike and no revenues at all ring a bell?). Don’t think that because you can’t get sugar or milk or because inflation is 50% that then the country is close to collapsin. It might seem like that to you because you have higher standards probably, not so for 95% of the population which is used to not having access to anything and they happily take the crumbs the Govt’s hands out.

What do you mean by PDVSA’s disgruntled creditors? You mean the U.S. oil companies or the local suppliers? Well, most of those contracts are under Venezuelan law, and we all know how the local law system works. On the contrary, some of Venny/PDVSA’s debt is written under NY Law and also have cross-acceleration clauses meaning that a default in one bond will trigger default in other bonds and obligations, etc.

Whenever the foreign financial establishment was involved, the Govt. always settled nicely (CANTV, EDC, Banco Santander). You think creditors and people who lend money are always sitting on their asses and doing nothing? Yeah there have been cases in the past of poor lending (subprime crisis, spanish crisis,etc). I highly doubt this is the case.

On the social programs I can tell you I fully understand. I am Venezuelan and lived in the country for most of my life, so I get the local idiosyncrasy. But since this is a subjective opinion, I’ll let some of the rough macro figures highlighted in a report by Merrill yesterday speak for themselves:

Tuesday, 26 November 2013

Venezuela Watch

External accounts improve

Current account surplus strengthens; cash holdings stabilize

Venezuela’s central bank published the country’s 3Q13 national accounts, including growth and external accounts data. The current account surplus showed a strong improvement, rising $1.8bn yoy and $2.1bn qoq to $4.1bn.The improvement was driven by an 18.1% decline in imports. This stands in stark contrast to the results of the first two quarters of the year. The data strongly supports our view that the country’s ongoing external adjustment is leading to a stabilization of its capacity to service external debt obligations.

Cash position stabilizes, lending to other countries declines

Non-reserve cash holdings of the public sector reached $20.1bn, a similar level to the 2Q13 $20.5bn level. The stabilization of cash holdings contrasts with their steep decline over 2012. The result is strongly influenced by the decline in lending to other countries, as captured by trade credits and other receivables. Trade credits (which includes trade-related loans such as those under the Petrocaribe agreements as well as import prepayments) fell from $1.9 bn in 3Q12 to $344mn in 3Q13 while other receivables (another modality of lending to other countries) fell from $1.4bn to $789mn over the same period. The decline in these two lines implies an improvement in the availability of cash to the public sector by $2.2bn.

Imports decline, driving deceleration

Economic growth decelerated to 1.1%yoy, below the population growth rate of 1.6%. But demand actually contracted 4.9%, with gross fixed capital formation falling 14.1%. The strong investment contraction suggests that the economy is likely to enter into recession in the next quarter. The contraction in imports appears to be playing a strong role: capital goods imports contracted 35.0% yoy in 3Q13, as opposed to 17.8% yoy for intermediate goods and an expansion of 2.9% yoy for consumption goods. In contrast to what happened in the first half of the year, public sector imports contracted 14.4%.

Adjusted accounts improve; remain positive

In Red matter, we argued that Venezuela’s external accounts were highly distorted because of the country’s unconventional policies, and suggested a new set of adjusted accounts that better capture the evolution of the country’s external position. Our adjusted accounts show yoy improvements in the current account by $2.5bn and by $1.7bn in the public sector current account, to $2.7bn and -$0.6bn, respectively. As we argued in Turning point ahead, the balance of payments data is one of several coming developments that we see as supportive of Venezuelan external debt valuations. Other developments include the December 8 municipal elections, where we expect a strong opposition showing, and the announcement of a devaluation, which we expect to take place no later than January of 2014.

LikeLike

Congrats Vinnie on the regime finances doing so well , must be very comforting for you , the future is full of bright promises of ever increasing profits. People are happy with their crumbs because in the past the mean old system didnt treat them as generously as the regime does today . In the past they had no access to meat , to milk , to sugar , to corn flour , to toilet paper , they were not given any education , crime was as rife as it is now or worse , its sounds just like a candified govt message.but of course this is the result of an impartial objective analysis !!

I dont know why the cost of insuring Venezuelan sobereign debt seems to be climbing , do you have a clue ?? The govts coffers are full and overflowing , production and exports of crude and refined products going up steadily , sweet light crude production (the money maker) is not falling . The cost of the inumerable govt subsidies is steady and under control , corruption doesnt make the least dint on the economy of Pdvsa transactions. Pdvsa has never had a healthier financial situation , The countries gold isnt being negotiated with Goldman to get a bit of cash , the chinese, the russians and other lenders and investors dont demand mortages on future production to ensure they get paid ( almost the only way of the govt getting financed nowadays) . the cost of paying the regimes mounting and accumulating debt doenst affect the govts income and operating capacity one bit, inflation is tamed and people both poor and middle class who go to the store have never been happier with the price of staples or goods !! The govt can cut customary benefits all it wants without people minding one bit . and of course the oil companies and other contractors and investors whose properties where confiscated never provided in their contracts for disputes and claims to be decided by international arbitration enforceable anywhere in the world . If by any chance default happens to ocurr the resulting maelstrom will not affect the bond holders capacity to recover their money in full , the regime has never planned for the possibility , hasnt a game plan to deal with it to its best advantage , is totally hamstrung in any attempt to defend itself from its creditors. Money printing and devaluations have no adverse effect on the regimes hallowed object of remaining in power indefinitely by their policy of distributing unsustainable benefits to its happy placid constituency and or the military !! Of course Im just pulling your leg , you evidently have an invested interest in believing the govt will do well and that makes you sensitive to all the bits of ‘good news’ that come your way , very human !! I also believe that default is not necessarily arround the corner but are less sanguine than your are as to the possibility of it ocurring if things get really rough , which they well might., and then no one even if they want to will be able to give you your money back . Youll be looking at a really rough hair cut !! I dont believe in forecasting things when they are so turbid , anything can happen and will happen . The odds for the regime maintaining an exemplary financial conduct with its bonds holders looks worse than they ever did in the past . anything else is whistling in the dark. , .

LikeLike

Jajaja chamo.No le pares. Ese tiene que convencerse a si mismo que todo está perfecto para poder seguir negociando, vendiendo y haciéndose rico con nuestros bonos y dormir en la noche.

LikeLike

Esto es todo lo que puedes aportar a la discusion? De verdad? Clasico ejemplo de uno de los problemas mas graves de Venezuela, la frivolidad y falta de profundidad al analizar las cosas. Cuando dije que todo estaba perfecto? No lo esta, pero eso no implica que el pais va a colapsar. Limitate a escuchar a Marta Colomina por favor y deja las discusiones para gente seria.

LikeLike

Sí vale. Nuestros mayores problemas son la frivolidad y la falta de moral de la élite que se enriquece a través de conexiones y arbitrajes y adquiriendo bonos con intereses usureros generados por la desastrosa gestión del gobierno para hacerse ricos con dinero que podría usarse construyendo escuelas y dotando hospitales.

LikeLike

Usureros? Estamos en la edad medieval acaso? La ignorancia es atrevida.

Osea que tu eres como Chavista pero en reversa. Ahora todo tiene sentido.

No hace falta tener “conexiones” para comprar un bono. Y el mundo no funciona de la manera que tu crees. Nadie esta impidiendo que el dinero se use para construir escuelas y dotar hospitales (que por cierto tambien deberian financiarse mas con fondos provenientes de la recoleccion de impuestos que otra cosa). El problema no es de las personas que prestan el dinero.

No tiene sentido que siga perdiendo mi tiempo respondiendo argumentos tan superficiales.

LikeLike

Chamo, tú como que no tienes mucho contacto con la realidad venezolana.

Sabes cuántas personas tienen una tarjeta de crédito en Venezuela? Sabes cuántos REALMENTE pueden incluso comprar dólares CADIVI? Todos? Todos? Tú has hablado con la gente promedio de una ciudad grande en Venezuela como Maturín o Punto Fijo? Sabes qué tendrían que hacer ellos para comprar dólares CADIVI? Qué cuentas de banco y QUÉ CAPITAL INICIAL tienen?

Y sabes cómo se llega a ese capital inicial?

Carajo, mis hermanos pueden comprar CADIVI pero el que ellos puedan no me ha cegado a mí para pensar que la mayoría de los venezolanos puede hacerlo.

Y en cuanto a los bonos: eso en Venezuela es una pirámide especulativa basada en lo que va a pagar la mayoría de la población en el futuro.

LikeLike

Kepler,

El hecho de la gran mayoria de la poblacion Venezolana no tenga acceso al sistema bancario no implica que hay que tener “conexiones” para tener una cuenta bancaria y acceso al mercado de valores. Lo que esto indica es el atraso del pais en esta materia, asi como en muchas otras. Cacr210 trata de colocar una etiqueta a las personas con acceso a los mercados financieros como una “elite” y con “conexiones” lo cual no es verdad. En otros paises, muy desarrollados o poco desarrollados, hay inversionistas que participan en los mercados de valores y no son necesariamente parte de una “elite”, es simplemente un mecanismo de ahorro e inversion disponible a la mayoria de la poblacion. Al pensar de esa manera, Cacr 210 parece ser parte de la poblacion venezolana cuyos estandares de vida son muy bajos (lo cual no necesariamente esta relacionado con el segmento social o clase economica). El hecho que Venezuela tenga el atraso que tenga no implica que cosas que son perfectamente accesibles en el resto del mundo sean un “lujo” en Venezuela. Lo mismo aplica a los productos basicos y bienes de consumo diario como la azucar. Dirias entonces que por que no se puede conseguir azucar entonces esta se convierte en un bien para gente con conexiones y en un lujo? No lo creo.

LikeLike

Bill,

I am not sensitive to “positive news”, those are facts and figures. As you can see, I read this and other blogs often (both opposition and govt.) and in general 90% of the more “informed and well stated” views reach to the conclusion that venny/pdvsa bond investors are nuts and will lose their shirts at some point. I am very much exposed to negative news around the idea of investing in these credits. And of course, I don’t completely dismiss the possibility of a default, it is a possible scenario with a low probability of occurrence in my opinion. The risk/return is well justified, more so because I’ve been collecting income at a high interest rate for more than a decade. What has the majority done instead? Sit around and criticise without analysing the situation objectively. If they would have analysed the situation objectively, then they wouldn’t have missed out on 14 years of income. 14 years of income and respecting coupon payments are not a fantasy, it is not “optimistic news”, its reality. Past event are not a guarantee of future events but these should be taken into account nonetheless One has to currently reassess the situation and accommodate accordingly. I don’t like the Govt. at all and I think the country would be better off with a different type of government. However, I analyse the situation purely from a financial perspective and act as such. Venezuela/PDVSA is a perfect contrarian investment.

By the way, markets are not perfect Bill. Do you actually think the price of CDS contracts are bullet-proofed? Or any price in the market for that matter? That is the “theory” not the practice. Institutions were willing to lend billions to Greece and Cyprus for a low interest rate because they thought it was unlikely for these countries to default and then what happened? Voila, a quasi-default, haircut and debt restructuring. CDS didn’t price this accordingly either and only spiked when it was obvious and too late of course. At least the people that invest in Venny/PDVSA are well rewarded for the risk assumed and I believe the market is over-estimating the likelihood of a default, thus, I buy.

The odds are worse than they ever did in the past? Funny, I’ve heard this one already dozens of times in the past. You need to come up with a better argument because lack of transparency and a banana government are not enough. Venezuela has been in a declining path for the last 30yrs.+, as such, the present will always look bad unless we go back to the Perez Jimenez era. You know how much it takes to recover your capital at rates of 10-15%? Not long.

Buy on the cannons, sell on the trumpets.

LikeLike

Sorry Vinny I guess I got carried away in gently lampooning some of your opinions , dont get offended but at times your views sound a bit too eager and self complaisant , You have a quarrel with people who criticized you investment strategies in the past which of course doesnt include me who am not a professional investor . If things have gone well with your purchase of Ven govt Bonds good for you . Im far from believing in the predictability or perfect rationality of markets , just as easily they could have gone the other way and hundreds of reasons would have been marshalled to demonstrate that it was meant to be . people do hanker to dupe themselves into believing what suits their greeds and conceits and never realize it !! CDS contracts arent always right but they are indicative of a state of opinion in the market which often does get it right !! I too dont go much for what happened in the past as a sign of things to come , When I say that things are worse than they were in the past I dont rely on what was said before , thats unimportant , I go for what I can see for myself comparing the past with the present and from bits and pieces of the flotsam and jetsam of information from inside the whale that come my way. The stink from the innards of the whale is worse than what is smelled outside it . Anyway dont think the govt will resort mucyh to the selling of bonds of the kind you purchased to finance itself . they can get better terms from the chinese and others using future oil deliveries as leverage.

LikeLike

Bill,

I don’t get offended at all! I think debating ideas and looking at the view of others is extremely important, especially when investing. I beg to disagree on CDS pricing by the way. And we do agree, things are bad and worse off but will that be significant enough to radically change the status quo? I don’t think so. You probably do and its a fair point.

Going forward, the less issuance, the best of course. Provided that this is not countered with a massive increase in debt from other sources.

LikeLike