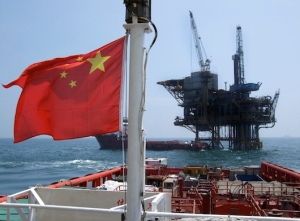

Over on Global Barrel, Tom O’Donnell makes the case that the Venezuela-China oil relationship has now reached a kind of critical mass that will keep it going far into the future, regardless of the politics on either side of the Pacific.

Over on Global Barrel, Tom O’Donnell makes the case that the Venezuela-China oil relationship has now reached a kind of critical mass that will keep it going far into the future, regardless of the politics on either side of the Pacific.

Soon, Venezuelan oil will not be shipped to China simply to fulfill financial-and-contractual obligations, but also for locked-in infrastructural reasons. All indications are that the Chinese side is actively fulfilling the obligations it entered into ca. five years ago (esp. December 2007) to build oil tankers, pipelines and refineries in China in order to import and process Venezuelan heavy crude. Billions are being invested and tens-of-thousands of Chinese workers are being employed.

All the activity on the receiving end contrasts with the snail’s pace of upstream development in the Orinoco Belt – so far – but the incentives to clear the multiple bottlenecks on the sending end seem likely to overwhelm opposition.

The interesting bit here is that as the Shale revolution moves North America towards energy independence on a much more compressed time scale than seemed imaginable even 5 years ago (North Dakota, for instance, now produces 50% more oil than Ecuador), Chávez’s determination to develop the Chinese energy relationship early might well be remembered as the best decision of his presidency.

Pura carambola, claro, but still…

So PDVSA needs to increase production to fulfill their obligations with the Chinese and just taking out part of the quota they sell to the US isn’t going to cut it. With the history of mismanagement and corruption that has plagued the company in recent years, I’m not surprised if down the line we would have to buy even more oil from the US just to honor the contract.

LikeLike

Esta el dicho q las oportunidades no se repiten. As money poured in during the oil boom, it should have been used to diversify the Venezuelan economy. Instead it was used to buy expensive Russian war toys that nobody knows how to use and are not being maintained, to become Robin Hood to South American and Caribbean countries, to buying foreign instead of promoting investment, and to enrich Chavez and his compadres. And to add insult to injury, it managed to deepen its debt while failing to invest in infrastructure. As the world is gearing to become renewable-energy driven, which includes China, Venezuela has chosen to believe that its path to the future can be sustained with the fossil tank alone.

LikeLike

Why would it be a good descision? US refineries would be quite happy to process and resell it to whomever, it doesn’t need to be their consumers. It’s not like Venezuela is getting a good deal out of China ‘alliance’.

LikeLike

Completely agree. He went there looking for El Gran Timonel Mao and struck gold (and Haier fridges)…

LikeLike

Ultimately the question is one of price and payment conditions , China’s distance makes it a costly and difficult to service market , if refineries are built in china to process venezuelan oil for supply to the chinese domestic market and this market carries subsidised prices , venezuela will lose in the bargain , also if the cost of transport and refining and distribution is controlled by Chinese interests and is skewed in its favour. Currently the fund is served through oil which is left largely unpaid which causes Pdvsa to have to defray expenses and taxes with money taken from other trades or through financial manipulation which is a headache for the current govtment . Very likely as professional’s at some point in time take over the running of Pdvsa , many of these conditions will have to be renegotiated or altered .

LikeLike

I think it may be less “carambola” and more self-fulfilling prophecy.

—

LikeLike

I still don’t see why it is a “decision”, good or bad, who you sell oil to. Oil is fungible, if the US has too much capacity, traders, the markets will take care of sending the supply where it is needed. The US refineries that process Venezuela’s high sulfure oil, still need high sulfur oil, while the oil coming out of North Dakota is different.

LikeLike

That´s exactly what Chinese are already doing. There are several discrepancies between what Venezuela sells to China, and to what China reports it imports from Venezuela. The fact is that Chinese companies are reselling Venezuelan oil in the international markets.

Regarding CITGO refineries in the US, I think that the fact that more oil will be supplied by shale will means more competition, cheaper prices and so on (of course, up to a point).

LikeLike

Its not a fact that the Chinese are reselling oil at higher prices. Its is a fact that PDVSA gets higher netback value for oil sold to the US, simply a matter of transportation costs which are borne by the seller. Makes more sense economically for PDVSA to maximize exports to the US.

LikeLike

Lobo : There have been reports that throughout the years China has been reselling at least part of the oil they get from Venezuela outside China , there was a first scandalous report by Wilkileaks . Later there have been reports published by China Brief (Jamestown foundation) dated feb 2013 (China and Venezuela , Equity Oil and Political Risk ) and which quote Pdvsa official stats of oil exports to China alongside Chinese Official Stats on Oil imports from Venezuela showing up to an 70 to 80 % disaparity between both figures for two yearss with an average 34% disparity up until 2011. It can be safely asssummed that the missing volumes were not thrown into the sea but that they were sold by the Chinese or perhaps swapped for closer to home crudes. Whether China made any money on these sales or swaps the bet is on The Chinese not losing any money on the transaction !! Venezuela produces much more extra heavy crudes than lighter crudes , heavy crudes cannot be processed at conventional refineries such as China currently posseses , it stands to reason that some of the crude and heavy products being sold to china could not be used by China and had to be sold elsewhere. The story may be murkier than we suspect but we really cant say for sure !!

LikeLike

If the Keystone Pipeline is given the green light, how will that affect America’s demand for Venezuela crude? Tons of crude, dirty oil will now be brought to the refineries in the Gulf from Alberta, displacing some of what usually comes from Venezuela.

LikeLike

If Obama gives the green light to the pipeline from Canada, AKA the Keystone Pipeline, it would most likely to complete trade the Venezuelan Oil for Canadian Oil, as to the properties of the Canadian Oil is almost same as Venezuelan one.

Even if the project is not approved, worst case scenario, USA will ultimately build the necessary logistic (Trucks, Tanks) to replace the Oil from unstable countries like Venezuelan and Middle East, and by 2016 ~ 2018, USA will be able to dismiss Venezuelan Oil as a reliable source of Oil.

And for this quote from FT, “Chávez’s determination to develop the Chinese energy relationship early might well be remembered as the best decision of his presidency”… I wouldn’t be so sure about it, since all the future productions are compromised to pay a debt of certain amount of money that we don’t know anything about it, how it was spent.

Then again I hope that FT was being sarcastic.

LikeLike

And some of the commentators used to wonder why the U.S. doesn’t “do something” about Chavez. The truth is that the U.S. just doesn’t “have a dog in that fight”. Chavez and his Bizarre Bolivarian Experiment has been a significant annoyance, but not a threat. Venezuela is going to have to sort out its own problems. If there is going to be any intervention at all, it will come from Colombia and Brazil, when they start being impacted by a severe refugee crisis on their borders.

LikeLike

If possible, Hugo Chavez does not make commercial decisions. The Chinese went to Venezuela, not the other way around. The Chinese have had an “equity oil” policy for the last 10 years or so. This policy has taken them all over the planet in the search for oil. Venezuela was a logical target and they found in Chavez a man in desperate need of cash.

Chavez is getting loans from the Chinese since 2006 or so, against the collateral of fuure oil shipments. This is illegal. It might be contested by a new Venezuelan government. Now, the Chinese are reluctant to lend Venezuela more money because, as Tom O,Donnel rightly says, Venezuela has not lived up to their side of the bargain and they are frowing increasingly afraid of a political backlash.

But there might be worse. As the western hemisphere shale gas revolution progress (although no exempt from problems) and shale oil also becomes closer to commercial development, the Orinoco area heavy oil might end up as a huge second or third priority item in the global energy equation. This topic is fascinating and deserves an in depth treatment.

LikeLike

The US is going to be needing imported oil for a long time , specially if the economics are right, they are seeking less dependence simply because the sources of supply are politically or geopolitically unreliable , they wont stop buying oil from Mexico , or Canada or Colombia or Brazil which are increasing their production , they will reduce their venezuelan purchases because they cant trust the Chavez regime nor its capacity to maintain a secure supply . Geographically and commercially the US is a much more favourable market for Venezuelan oil , the one with the best prices and the most convenient logistics . China is one of the worst because the transportation cost is among the highest and china needs to change its refining makeup to process our crudes. Also their domestic prices are regulated unlike those in the US and that means a smaller capacity to pay for Venezuelan crudes. The use of Venezuelan crude to fund the Chinese funds is done in a way that is highly prejudicial to Venezuela largely because its basically paid for in the form of project loans which represent a huge waste and mismanagement of Venezuelan resources , using chinese companies at inflated prices in projects that dont always make commercial sense. China is not a natural market for Venezuelan crudes and trading with it has costs which could have been avoided if we ve had more normal relations with the US.

LikeLike

saying heard in Alberta in the ’80s and even to this day…”Lord, grant me one more oil boom, and I PROMISE I wont piss it away this time”. Maybe chavistas are praying the same prayer?

LikeLike

At over 40 years and counting in power, maybe the Alberta Progressive Conservative Party is a model for the PSUV. ;)

LikeLike

dude!!! OMG!! after dealing with ralphie boy for a decade with his drinking, I don’t think ANYTHING can upset Albertans…cheers bro

LikeLike

After reading all the comments, I would like to submit some additional things to consider:

1. Oil is produces much more than fuel. It is the raw material for almost all chemical products.

2. A component of Chavismo decisions is their strong anti-USA sentiment. I recall at one time, Chavez wanted to keep Venezuela foreign reserves in Euros!

3. Venezuela oil reserves are so large that they are probably considered to be something like a credit card by Chavismo.

4. China has been acquiring access to mineral resources from third world countries using different tactics including loans, building hospitals, providing the mining, transportation, refining, distribution solutions that these countries cannot perform by themselves. What’s happening in Venezuela is nothing special considering that Venezuela is becoming a helpless third world country.

LikeLike

Gordo: Your four conclusions are correct but need a bit of polish :

1.- The petrochemical business requires propportionally more investment and is much less luchrative and stable than the oil business , it feeds more on gas than it does in crude oil , the cost of expanding gas production in venezuela es much higher than is usually thought thus reducing the benefits of any conversion of gas into petrochemical products.

2. The Chavez regime prefers to make poor business deals with China than better business deals with other Western european countries , guided by an ideologically inspired delusion .

3.. Venezuelas reserves are mostly in extra heavy crude which is much more difficult and costly to produce and process and has a more limited market , hence it brings in less money that lighter crudes , this reduces the importance it has in the world balance of oil resources.

4. China has a long term policy of acquiring access to oil resources from third world countries in ways that are less straightforwardly commercial than Western companies use , the bottom line however is that all these investments must in the end make money for china . They look forward to economic growth that will make them into insatiable consumers of crude , but they have no political loyalties , only long term commercial ones . Venezuela is currently because of its regime ‘easy pickings’ but if the regime changes they will be equally willing to play along with any regime which is more conventionally western in its outlooks , they will drive a hard bargain but they will in the end make whatever accommodations will secure them the oil they think they will need in the future.

In short oil as a substance is only part of the story , its exploitation is much more diverse and complicated than people usually think and the really important thing about oil is the kind of money it can generate under different conditions and scenarios.

LikeLike

Thanks for the plug, Francisco. A few comments on comments here (I’ll put most this over at my comments page too):

– Re. heavy-oil capacity in the US Gulf region that has historically received Venezuelan crude: When the Albertans were in NYC about two years ago to promote a public offering of their heavy oil on Wall Street, they had a meeting at the Canadian embassy. I asked them if the KeystoneXL had anything to do with PDVSA not using heavy oil capacity in the US Gulf Region. The diplomat types avoided the issue; but the mayor of Calgary jumped in saying, roughly: “Hell yes! … we’re happy to take that the capacity the Venezuelans aren’t using.” I don’t think PDVSA/CITGO are in serious trouble with their US capacity if they don’t send Venezuelan crude there. There are other takers … and PDVSA seems to have so far done pretty well when they’ve sold off US and EU capacity.

– Internal Chinese subsidies are an issue, yes. CNPC’s PetroChina is not only building refineries inside China to compete at home with the stronger Sinopec. The heavy-oil refinery going up in Guangdong is actually PetroChina’s first “big move” into that province, which Sinopec dominates. But, both are also looking everywhere internationally right now to buy up refineries so that they can refine and market more oil that they either don’t need to or can’t take home (not yet) given domestic refinery constraints and shipping costs, etc.. The foreign buy up of refineries is to escape the lower profits that domestic price controls/subsidies impose at home.

— However, subsidies or no, there is still a lot of money for Chinese NOC’s to make at home. And, bringing oil directly home in bi-lateral agreements with producers (such as Chavez was enthusiastic about) is consistent with the Chinese state’s “Go Abroad” policy since they lost domestic self-sufficiency in oil. This has to to do with taking care of China’s delicate home market, but also with the state’s geostrategic interests in developing a capacity to avoid the global market where the US has such great leverage (viz: Iran sanctions), This is always on Beijing’s mind if they are to become an independent Great Power, and not end up like Japan before/during WWII. (The Asia Times link EmmanuelV contributed discusses these issues .)

LikeLike